MAM launches the Montanaro Global Innovation Fund (“GIF”)

Launched on 29 June 2021, GIF invests in quoted Global Small and MidCap companies that are leaders in technological innovation. Through its focus on Smaller Companies, the Fund offers investors access to a vast investable universe of over 4,000 companies and complements Technology Funds in the market that predominantly focus on the largest companies in the world, such as the FAANGs. We believe that GIF is different.

GIF is managed by Guido Dacie-Lombardo, who is supported by Yannis Gidopoulos and Hal Miller. They lean on our in-house team of 14 analysts and the wider MAM team of 36, one of the largest specialist Small and MidCap teams in Europe.

The Fund is supported by a highly experienced Advisory Committee of experts in the fields of technology, innovation and healthcare. The Committee is chaired by David Gann, CBE, Chairman of the UK Atomic Energy Authority and a member of the UK Government’s Innovation Expert Group. David is joined by Anne Glover, Benedict Evans and Dr Axel Heitmueller (biographies below).

The Fund has enjoyed a strong start showing a positive total return since launch of 13% (in GBP, to 31 October 2021), outperforming the MSCI World SMID Cap (Net TR) Index by 9% and ranking as the second best-performing Fund (out of 461) in the IA Global Sector.

Until 31 December 2022, all share classes of the Fund will be charging a reduced management fee of 0.25% p.a. (with no Performance Fee*).

MAM and Charles Montanaro have seeded the Fund with £6 million of their own money, one of our largest investments in the launch of a new Fund.

David Gann, Chairman of the Advisory Committee, said: “This is an exciting time to launch a new Small and MidCap Fund, with a strong pipeline of technology companies coming to IPO and so many quoted Smaller Companies creating remarkable value for their shareholders. The Montanaro Global Innovation Fund offers excellent opportunities for investors.”

Cedric Durant des Aulnois, CEO of Montanaro Asset Management, said: “The Global Innovation Fund is the culmination of our 30 years of experience in researching and investing in some of the most innovative Smaller Companies in the world. With GIF, we are offering investors access to some of the most exciting but often overlooked Technology companies that will be shaping the world of tomorrow.”

The Advisory Committee

David Gann, CBE

David is Chairman of the UK Atomic Energy Authority and a member of the UK Government’s Innovation Expert Group. He was a member of the Department for Health and Social Care Technology Advisory Board. He Chaired the Smart London Board from 2012 to 2017 reporting to two Mayors of London.

Anne Glover

Anne co-founded Amadeus Capital Partners in 1997 and has been an active venture capitalist for over 30 years. Anne started her career in the Unites States where she worked at Cummins Engine Company and Bain & Co. Upon her return to the United Kingdom she joined Apax Partners and became Chief Operating Officer of Virtuality Group before founding Amadeus in 1997. Previously, Anne chaired the British Private Equity and Venture Capital Association from 2004 to 2005 and Invest Europe from 2014 to 2015. Anne is a member of the Investment Committee of Yale Corporation and earlier this year she was appointed as an external member of the Venture Capital Investment Committee of CDC Group, the UK’s development finance institution.

Benedict Evans

Benedict Evans is a consultant, author, public speaker and technology expert. Benedict has spent the past 20 years analysing mobile, media and technology data, and worked in equity research, strategy, consulting and venture capital. He is the author of Benedict’s Newsletter which has over 160,000 subscribers. Benedict is a Venture Partner for Mosaic Ventures and Entrepreneur First and has been involved in these organisations since early 2020.

Dr Axel Heitmueller

Axel Heitmueller is Managing Director at Imperial College Health Partners, which supports the adoption and diffusion of best practice in healthcare. Prior to this, Axel was Executive Director of Strategy and Business Development at Chelsea and Westminster Hospital NHS Foundation Trust and Deputy Director and Chief Analyst at the Prime Minister’s Strategy Unit in the Cabinet Office and No 10. Axel has extensive experience in providing strategic and intellectual leadership and managing complex stakeholder networks. Axel is also Visiting Professor at the Institute of Global Health Innovation at Imperial College.

Fees

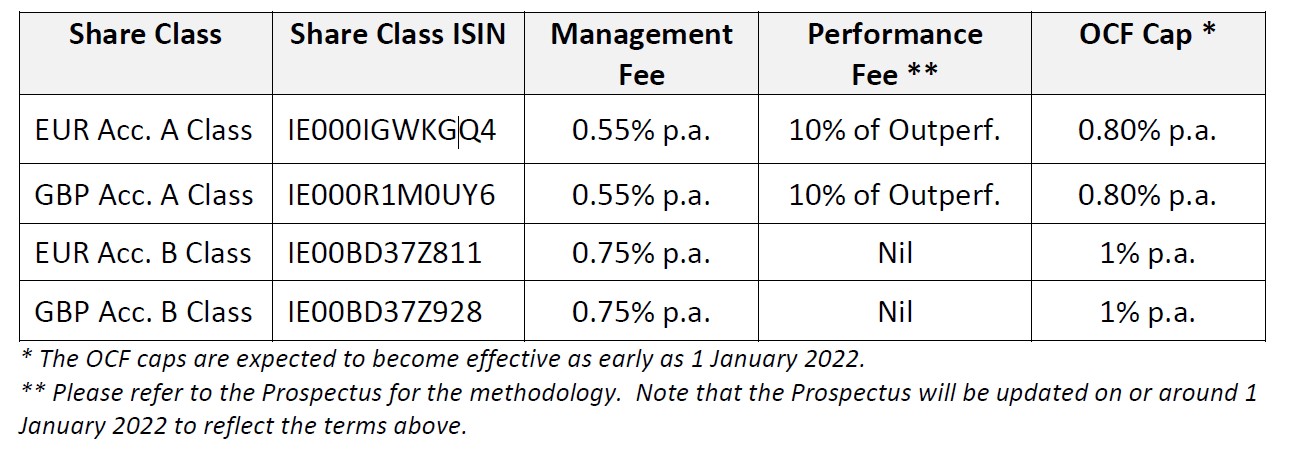

Until 31 December 2022, all share classes of the Fund will be charging a reduced management fee of 0.25% p.a. (no Performance Fee*).

From 1 January 2023 the following fees will become applicable:

About the Montanaro Global Innovation Fund:

The Fund invests in Small and MidCap companies quoted in global markets that are leveraging enabling technologies – ranging from semiconductors to robotics, from cloud computing to artificial intelligence, and from energy storage to genetic sequencing & engineering technologies – to create new applications in their chosen end markets and to drive growth. Such companies will be active across all major sectors of the economy, including industry, consumer, enterprise, finance and healthcare.

The Fund aims to achieve capital growth in excess of the MSCI World SMID Cap Index.

The Fund is classified as Article 8 for the purpose of SFDR.

Please find the KIID and Prospectus here

Contacts

For further information please contact:

Tom Norman-Butler: tnormanbutler@montanaro.co.uk

Chris Crier: ccrier@montanaro.co.uk

Adam Lomas: alomas@montanaro.co.uk

Christian Albuisson: calbuisson@montanaro.co.uk

Henrik Schmidt: hschmidt@montanaro.co.uk