The Benefits of SmallCap Income

We recently wrote about the lack of investor love for UK SmallCap. In the article, we highlighted three reasons why sentiment towards SmallCap might reverse. The first was currency; the second valuation; and the third future returns. In recent days, we have been reminded of a fourth: income. This may seem strange to those who equate income solely with LargeCap stocks. But the vulnerability of aristocratic LargeCap dividend payers has been in the news, once again.

Vodafone has cut its dividend. The 40% reduction in the payout was the company’s first cut since the dividend was introduced in 1990. Although the CEO informed the market last November that “sufficient headroom” existed to pay the dividend, a “combination of factors” subsequently made this impossible.

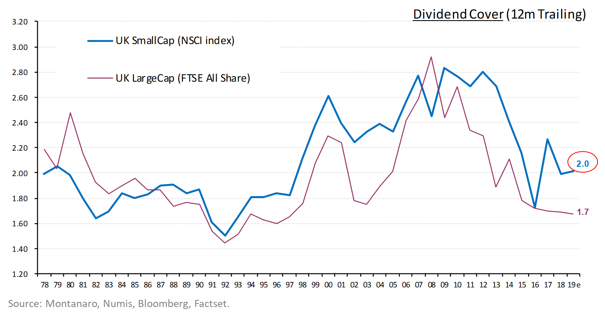

Vodafone’s plight highlights the importance of the dividend cover. This is a ratio of a company’s earnings per share to the dividend per share. In other words, how many times over a company’s dividend can be paid by earnings – and what is left over (“retained earnings”) to reinvest for future growth. A ratio of below 1x means the dividend cannot be paid by earnings. The company would either have to cut the dividend, or borrow.

Vodafone’s dividend cover of 0.77x was a warning sign. The company could not pay the dividend out of earnings. As a rule of thumb, income investors like to see dividend cover close to 2x. Such a level gives the company breathing space – or “headroom” – to pay the dividend and also make any necessary investments in the business.

It is therefore interesting that the FTSE All-Share (an index weighted heavily towards the UK’s largest companies) currently has a dividend cover of just 1.7x. Meanwhile, the UK SmallCap market – as represented by the Numis Smaller Companies Index – has a dividend cover of 2x.

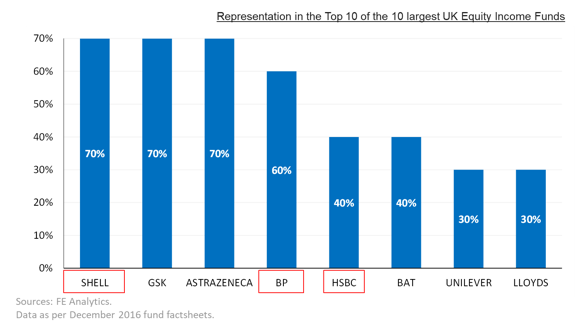

Dividend cuts are painful. They are doubly so if investors own more than one LargeCap income fund and discover that these funds are exposed to the same stocks. The chart below shows the representation of the UK’s top 10 income paying stocks in the UK’s 10 largest Equity Income Funds. Many of these funds source income from the same stocks.

Little wonder that investors are diversifying income streams by allocating to UK SmallCap Income Funds. Such diversification helps to keep income streams flowing, even when a staple payer announces a cut.

Any comments or feedback can be sent to: blog@montanaro.co.uk