An Extraordinary Fourth Quarter

Investor sentiment changed dramatically in October. The result was that many indices fell through the psychologically important 10% mark during Q4, wiping out returns for the year. Volatility was blamed on the narrative of 2018: worries about a global economic slowdown, rising interest rates, and unpredictable politics.

As we have previously noted, there is a seasonal element to SmallCap. But no “Santa Rally” emerged in 2018. Instead, it was a very unusual end to the year.

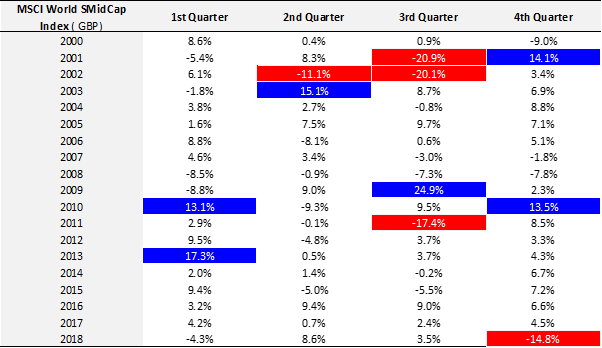

The following tables help to place the quarter in context. The first shows the quarterly returns of the MSCI World SMidCap Index since 2000. The last quarter of 2018 was the worst Q4 for the index this millennium:

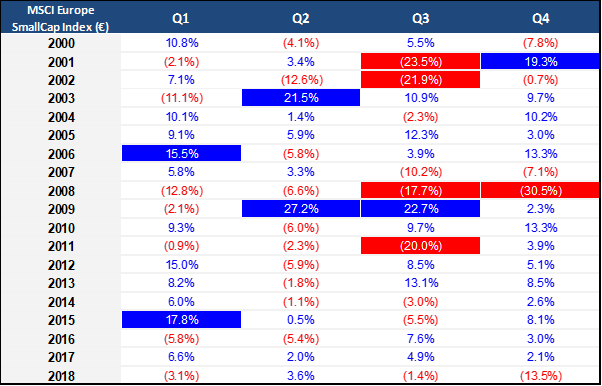

It was a similar tale for the MSCI Europe SmallCap Index, which experienced the largest quarterly decline since the Eurozone crisis (when the index fell by 20% in Q3 of 2011):

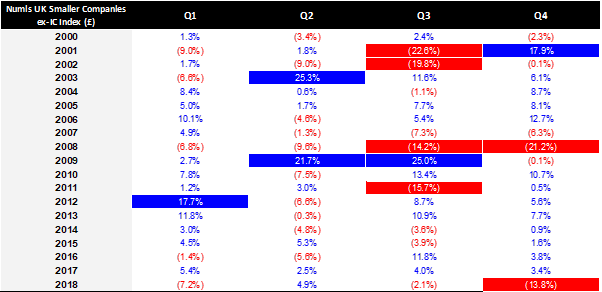

The Numis Smaller Companies (ex-Investment Companies) Index fared no better in the UK. Not since the Financial Crisis have we seen such a poor end to the year:

Clearly this has some positive implications for stock pickers, not least on valuation. This is something that we will turn to in a future blog post.