MAM launches the WS Montanaro Europe (ex-UK) Small & Mid Cap Fund

We are pleased to announce that the WS Montanaro Europe (ex-UK) Small & Mid Cap Fund (“WS-MESMF”) was launched on 5 April 2024, following a successful EGM held on the same day to approve the conversion of the WS Montanaro European Income Fund. The Fund is currently over £40 million in size.

The WS-MESMF is managed by George Cooke, who has been at the helm of the Montanaro European Smaller Companies Trust (“MESCT”) since 2013. During George’s tenure, MESCT has produced an annualised NAV return of 12% p.a., outperforming its benchmark by c.2% p.a..

George is supported by our well-resourced and experienced Investment Team, which consists of 18 Analysts and Portfolios Managers following the hiring of Adam Montanaro in September 2023.

Building on the success of MESCT, the WS-MESMF invests in what we believe to be the highest quality Small & MidCap companies quoted in Continental Europe. The Fund has a target of 40 to 50 high conviction holdings.

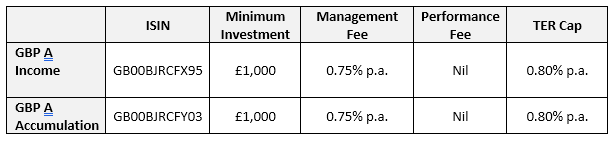

The OCF for both the Income and Accumulation Share Classes has been capped at 0.80% per annum. See further details below.

Cedric Durant des Aulnois, CEO, said: “For many years our investors have been asking us for an open-ended vehicle enabling them to gain exposure to the capital growth potential of Continental European Smaller Companies, which has been aptly illustrated by the successful track record of MESCT. We are excited to finally have a Fund available.”

For the avoidance of doubt, the Montanaro European Income Fund, a £200 million UCITS Fund domiciled in Ireland, will continue to be managed by Alex Magni in future. MAM remains firmly committed to its Europe ex-UK income strategy and looks forward to building on the Fund’s past success. The Montanaro European Income Fund will celebrate its 10-year anniversary next year.

About the WS Montanaro Europe (ex-UK) Small & Mid Cap Fund:

The Fund aims to achieve capital growth in excess of the IA Europe (excluding UK) Sector over any five-year period by investing at least 60% of its assets in the shares of small and medium sized companies (i.e. companies with a market capitalisation below €20 billion) listed or traded on a stock exchange in the European Union, Iceland, Norway or Switzerland.

Please find the KIID and Prospectus here.

ACD: Waystone Management (UK) Ltd

Depositary: Bank of New York Mellon (International) Ltd

Registrar: Link Fund Administrators Ltd

Auditors: Ernst & Young LLP

Contacts:

For further information please contact:

Tom Norman-Butler: tnormanbutler@montanaro.co.uk

Chris Crier: ccrier@montanaro.co.uk

Harry FitzGerald: hfitzgerald@montanaro.co.uk

Dan Powner: dpowner@montanaro.co.uk

Christian Albuisson: calbuisson@montanaro.co.uk