Putting January 2022 into Perspective

At Montanaro, we spend virtually no time ploughing through short-term market and macroeconomic data in the hope of being able to work out what might happen in the future. We leave the art of reading the runes to the pundits and the new generation of AI-powered robots – they are far better at it than we will ever be. To our untrained ears, much of this data is just noise anyway.

Occasionally, however, something dramatic unfolds in financial markets and warrants further investigation. The intense style rotation – from Growth to Value – we witnessed in January 2022 certainly qualifies as one of these “dramatic” events. The speed with which it occurred was unprecedented. Moreover, this occurred against a backdrop of eroding risk appetite marked by falling equity markets and a sell-off in SMIDCap equities in favour of LargeCap. Our Funds, all of which are managed according to the same SMIDCap “Quality Growth” investment approach, recorded one of their worst months ever in relative terms.

The reasons behind this brutal change of market sentiment are well known: the burst of global inflation has been stoking fears of interest rate rises which has disproportionately hurt long duration assets, notably Growth Small & MidCap equities. But let’s look at the data….

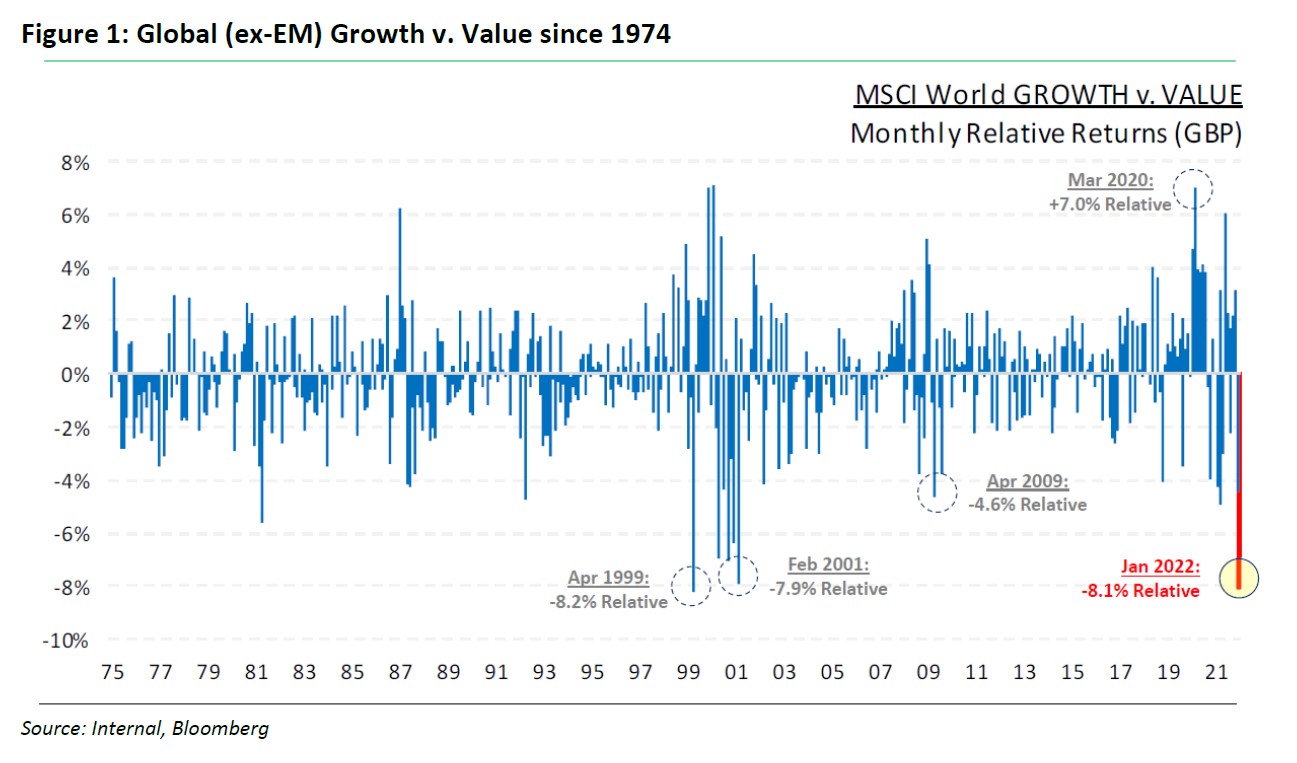

The MSCI World Growth index underperformed its Value counterpart by a whopping 8.1% in January, the second largest such underperformance in almost 50 years (only topped by April 1999, when Value enjoyed a brief respite amidst the dot-com frenzy). As money gushed out of the FAANGs and other Technology and Healthcare names, the Banking, Materials and Energy sectors enjoyed a strong revival. The NASDAQ Composite index retreated by 9% with Amazon, Tesla, eBay and Netflix all losing 10% of their value or more.

This shift towards Value was visible across all major regions – including the US, Continental Europe and the UK – and across size brackets – SmallCap, MidCap and LargeCap.

In the past, such periods of intense rotation into Value tended to coincide with a “risk-on” backdrop in equity markets. For instance, when Value came back to the fore in April 2009, marking the onset of a new Bull Market, there was a clear shift across all corners of financial markets in favour of higher beta assets such as Small & MidCap. For SMIDCap investors with a Growth bias, this is a welcome natural hedge against a style rotation.

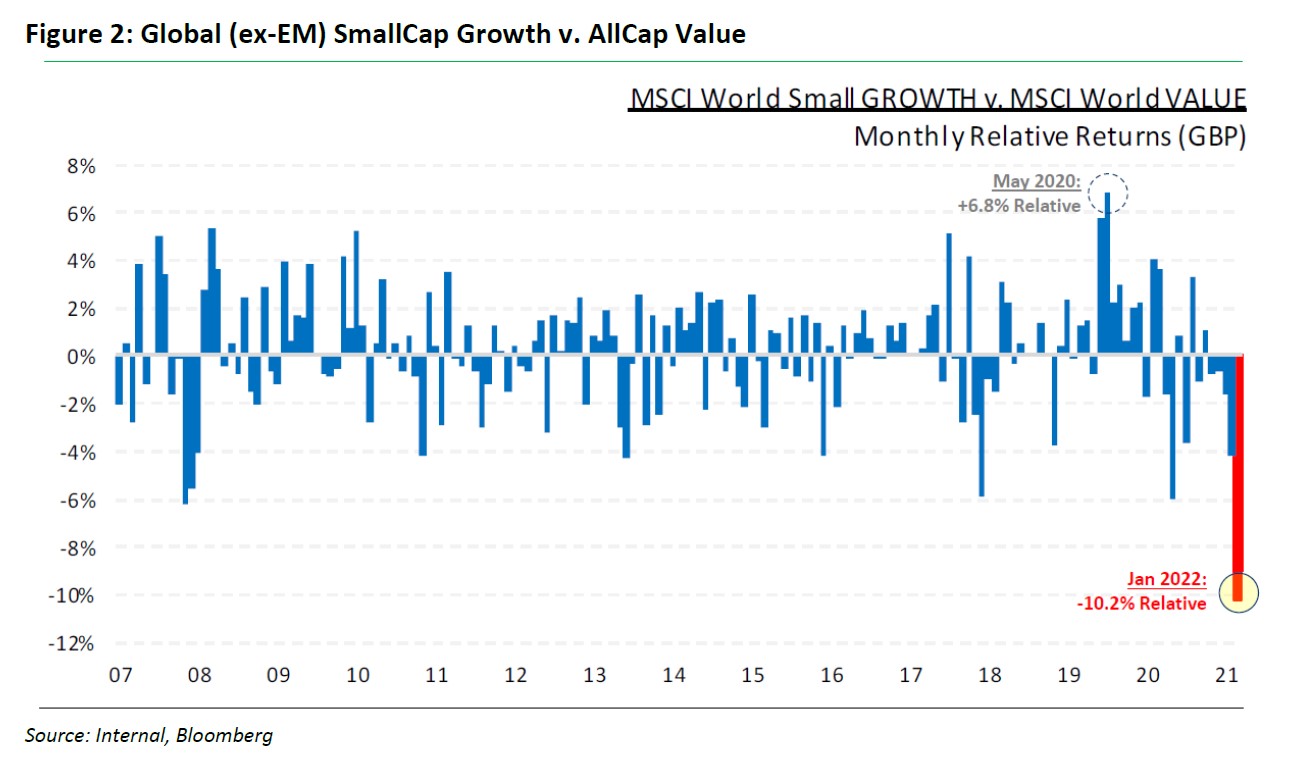

But there was no such hedge on display in January 2022. SmallCap underperformed LargeCap by 3% globally, by 4% in Europe and by more than 5% in the UK. Add this to the style rotation and now take a look at Figure 2 below: Global SmallCap Growth lagged AllCap Value by more than 10% during the month, easily topping all previous records since records began 15 years ago. It was a rough time for Growth SMIDCap investors.

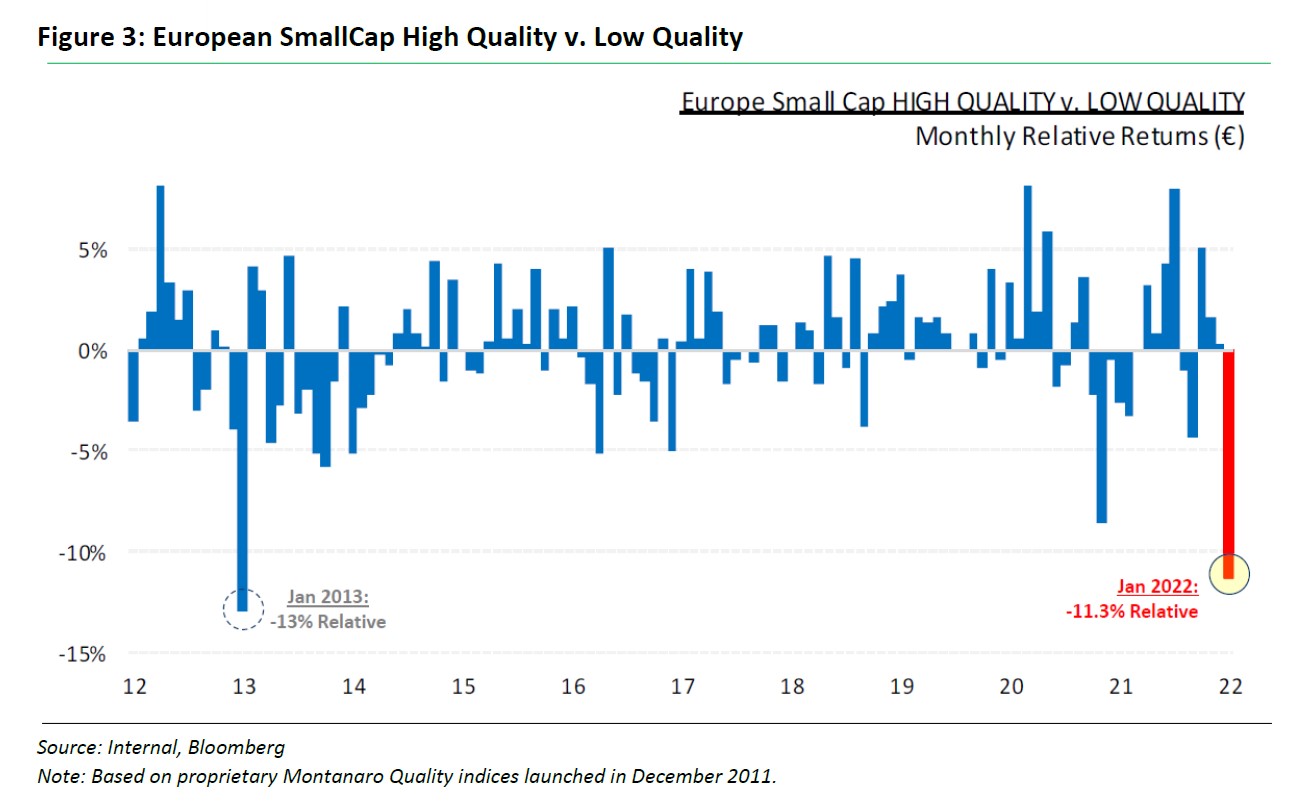

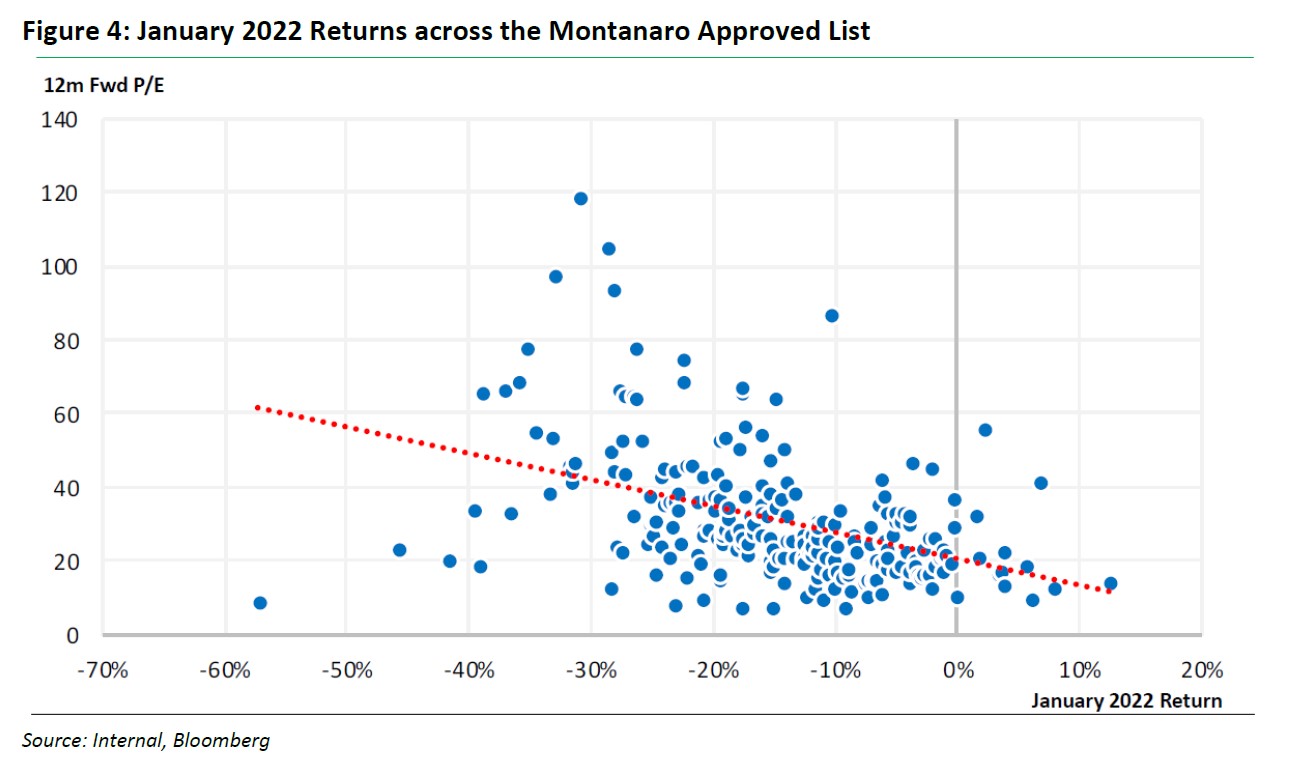

Naturally, these trends were clearly visible within our own investable universe of “Quality Growth” companies. Our home-made European SmallCap High Quality Index underperformed its Low Quality index the most since we launched these indices back in 2011 (see Figure 3). Similarly, the companies trading on the highest P/Es performed the worst and vice versa: 4 of the 5 best performers on our Approved List were trading on a P/E of less than 19x – see Figure 4 below. [As our investors will know, we consider headline P/Es to be of limited value but we are using them here for simplicity.]

So where does this leave us in terms of valuations?

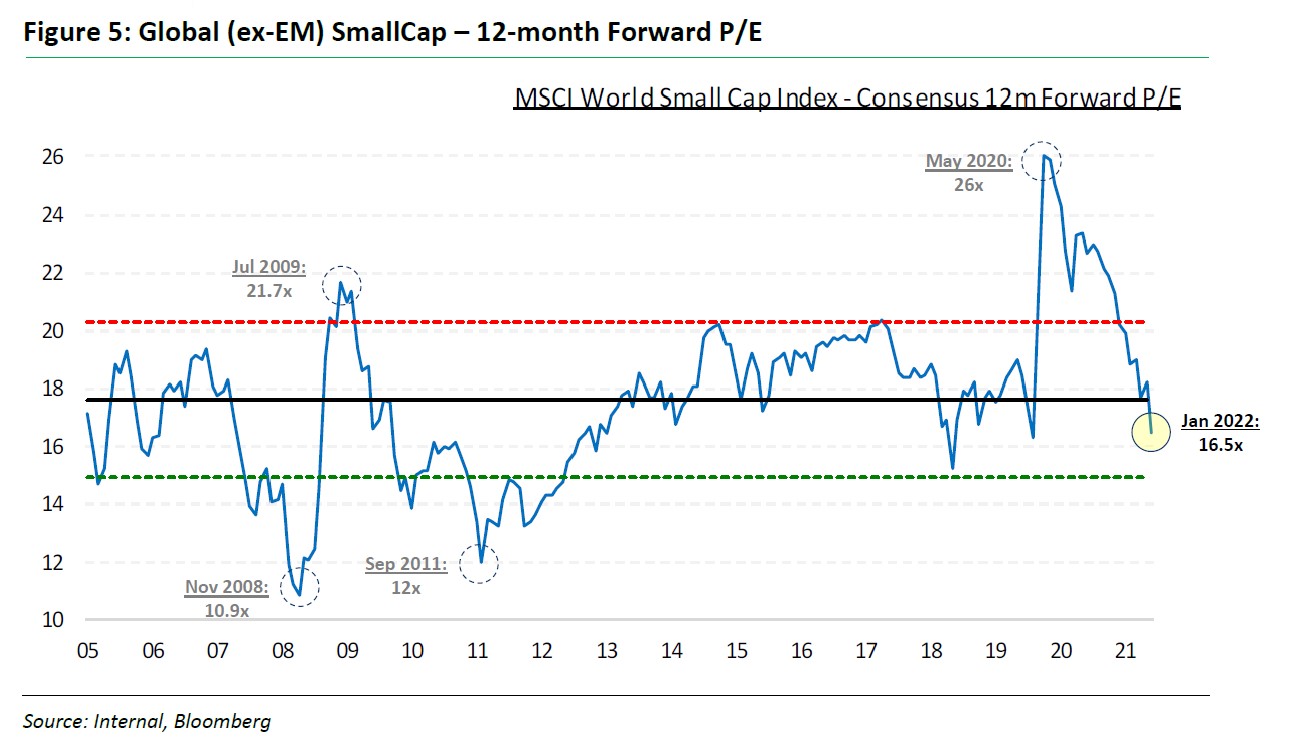

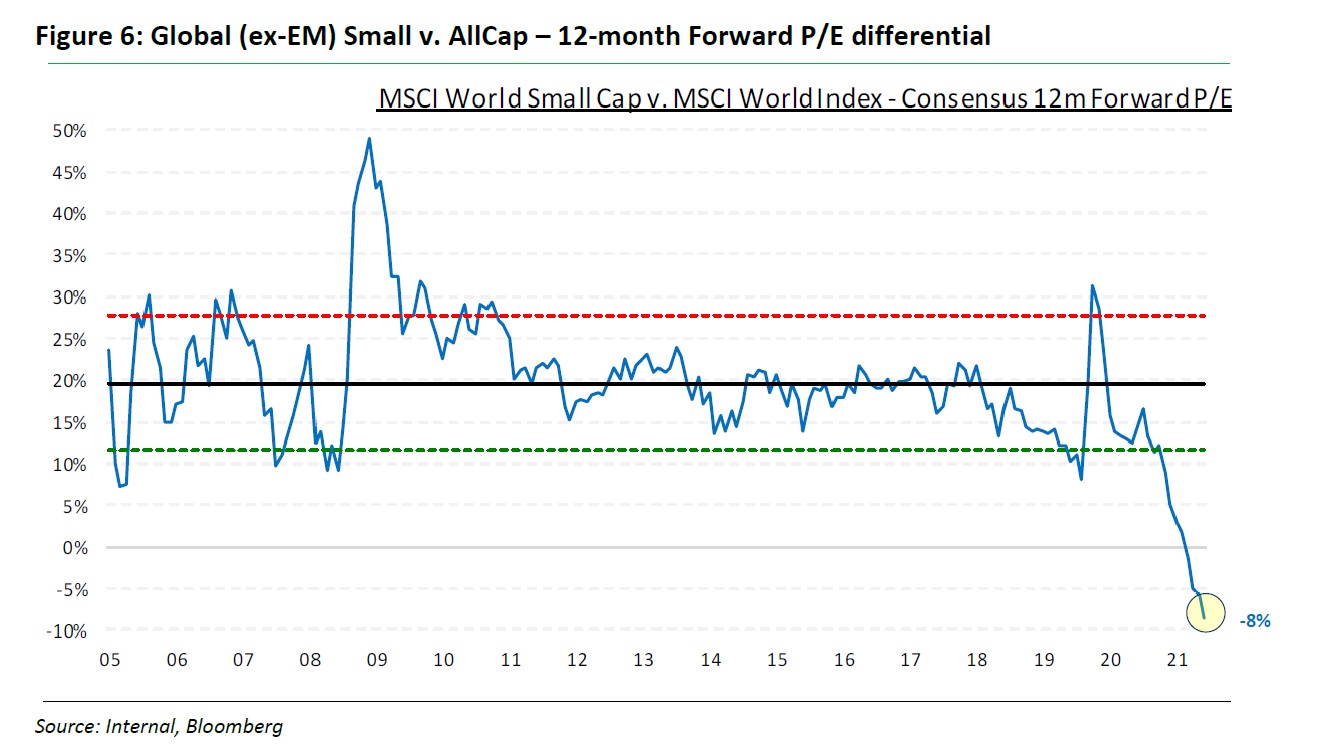

Firstly, let us take a look at size. Global SmallCap has derated strongly – both in absolute terms and relative to LargeCap – since the onset of the pandemic. As Figure 5 shows, the MSCI World SmallCap index is now trading on “only” 16.5 forward earnings, below its long-term average of 20x. The derating vs LargeCap is even more eye-catching: SmallCap is now trading on an 8% discount, by far the largest discount in almost 20 years (and possibly more, sadly the data only goes back to 2005).

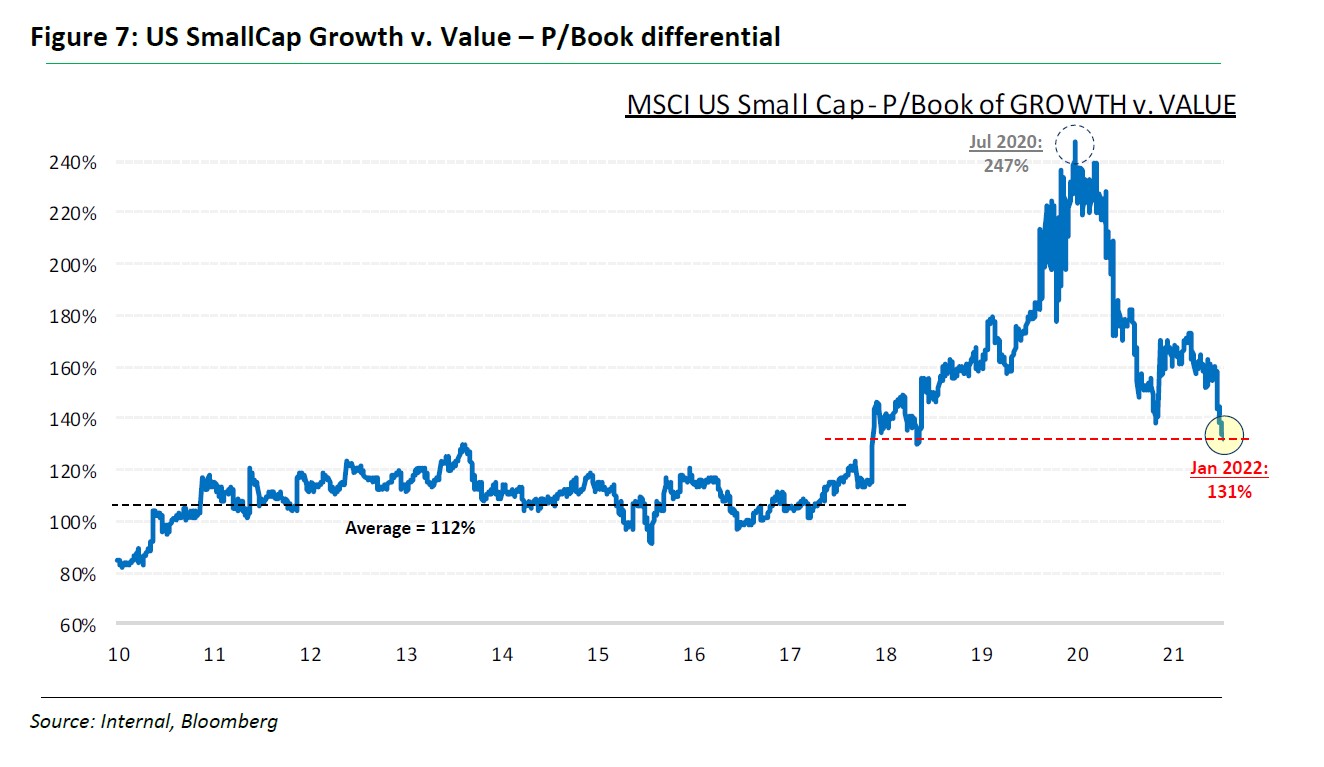

Now let us add style to the mix. Unfortunately, we do not have valuation data for Growth and Value within Global SmallCap or SMIDCap. We do, however, have some history for the US, which accounts for well over 50% of the World index by value.

Figure 7 highlights the scale of the derating of Growth within US SmallCap, which started 18 months ago. The significant re-rating of Growth that took place between mid-2018 and mid-2020 has been all but erased. On Price-to-Book, Growth is trading only marginally above the pre-2018 average premium. Similar observations can be made in Europe and the UK.

So where does that leave us? We will not risk any predictions about what the future holds for inflation and interest rates (we tend to think that today’s inflation is creating a deflationary backdrop but who are we to say – you can read our musings last year on the subject here). Irrespective of macroeconomic developments, we believe that SmallCap (and SMIDCap) is offering significant value to investors with a medium-to-long-term horizon. Meanwhile, Growth has also de-rated significantly versus Value and turned the clock back 3 to 4 years. While none of this will change the way we invest – we spend our time working out whether our companies can replicate their past success over the next decade – it is helpful to uncover the reasons for our underperformance.

While we can only apologise for the recent underperformance of our Funds, the message we are getting directly from our investee companies is reassuring. Many have reported strong earnings numbers in recent days – some have even raised their profits guidance – and many are seeing inflationary pressures moderate, particularly on the logistics and freight front.