Montanaro Asset Management’s Commitment to Nature and Biodiversity

A Bold Step Towards a Sustainable Future

The world is undergoing a profound transformation, one that requires us to reconsider our relationship with nature and the environment. For too long, humanity has operated on the assumption that nature is external to our economic systems. However, the consequences of this belief, including biodiversity loss and ecological damage, have been far-reaching and unsustainable.

A Wake-Up Call from the WWF Living Planet Report

The most recent WWF Living Planet Report offers an examination of global biodiversity trends and the state of our planet. It has delivered an alarming message that compels us to pause and reflect on the perilous condition of our natural world. Since 1970, the report reveals that global wildlife populations have suffered a catastrophic average decline of 69%. This profound and rapid drop serves as an urgent wake-up call, signalling that the rich tapestry of biodiversity, which forms the foundation for life on Earth, is in critical jeopardy[1].

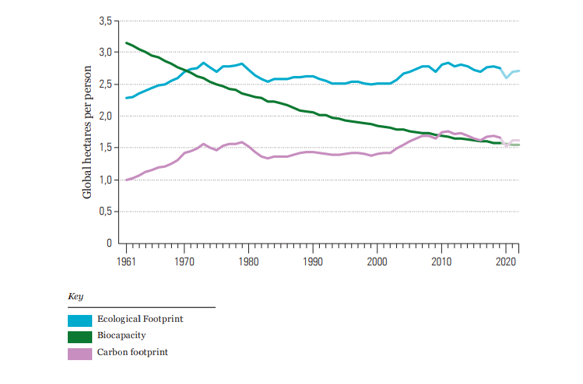

The Living Planet Report also contains research on biocapacity. The planet’s biocapacity serves as the fundamental gauge of its ecosystems’ ability to regenerate essential resources and absorb waste, underpinning all life systems on Earth. It encompasses the vital role of providing biological resources to sustain human needs while also mitigating the environmental impact of waste production. This delicate balance can be quantified by measuring both biocapacity and the human demand placed upon it, known as the Ecological Footprint. The Report has found that Humanity’s Ecological Footprint surpasses Earth’s capacity to regenerate resources. Ecological Footprint accounts reveal humanity’s overuse of our planet’s resources, with an excess demand of at least 75%, akin to living as if we had 1.75 Earths at our disposal. This overconsumption not only erodes the planet’s ecological health but also endangers the future prospects of humanity.

The chart above is taken from The Report and shows the biocapacity from 1961 to 2022 in global hectares per person. The blue line is the total Ecological Footprint per person, and the pink line is the Carbon Footprint per person (a subset of the Ecological Footprint). The green line shows the biocapacity per person.

This continuous overuse of natural resources and a disregard for ecological balance have significantly contributed to dwindling biocapacity, pushing our planet to its limits and making it imperative for us to redefine our ecological footprint for a more sustainable future.

Some Good News from the United Nations

In 2022, the United Nations (UN) General Assembly took a significant step by recognising that every individual has the right to live in a clean, healthy, and sustainable environment. This recognition elevates the responsibility for governments and businesses to respect this right, making it not merely an option but an obligation.

Although this recognition isn’t legally binding, it is expected to expedite action. The right to a healthy environment has already led to the development of stronger environmental regulations, better enforcement, increased public engagement, and, most importantly, enhanced environmental preservation. Citizens worldwide have used this right to protect endangered species and ecosystems, demonstrating the potential for positive change when fundamental environmental rights are upheld[2].

In addition, outcomes from COP15 (the UN nature summit which concluded in December 2022) delivered a robust set of targets that signal a global commitment to protecting our planet’s precious ecosystems. Key highlights include the ambitious “30-by-30” target to safeguard 30% of land and 30% of coastal and marine areas by 2030, including Indigenous and traditional territories. The deal also aspires to go beyond protection and restore 30% of degraded lands and waters throughout the decade, with a focus on preventing the destruction of intact landscapes and areas with high species diversity by 2030.

In addition there has been a call for:

- annual financial pledges for conservation;

- requiring big companies to report on their biodiversity impacts;

- an agreement focused on reducing the risks associated with pesticides and highly hazardous chemicals; and

- efforts to eradicate harmful subsidies.

All of which demonstrate a concerted push towards sustainability[3].

The State of Nature Report 2023

At a national level the recent State of Nature Report 2023 paints a vivid picture of the biodiversity landscape across the UK, and its findings are not to be taken lightly[4].

The report reveals that, on average, species studied have declined by 19%, and over half of plant species have seen their distribution dwindle by 54%. What’s more, nearly one in six of the over 10,000 monitored species in Great Britain now faces the peril of extinction. Among these vulnerable species are beloved and iconic creatures like the Turtle Dove, Hazel Dormouse, and European Eel.

The report isn’t solely a harbinger of doom; it highlights ongoing efforts to combat biodiversity decline. Restoration projects for natural habitats, including peatlands and seagrass beds, are gaining traction to halt the slide of plant and animal species. This aligns with a broader government commitment to protect wildlife and landscapes in the UK.

Whilst there are some glimmers of hope, overall the State of Nature Report 2023 serves as a stark reminder of the ecological challenges we face and reinforces the importance of corporate initiatives that actively support and accelerate efforts to protect and restore biodiversity.

Our Action

Recognising the urgency of the situation and the need for a paradigm shift, Montanaro Asset Management (“MAM”) is proud to unveil our Biodiversity Policy. This policy represents our unwavering commitment to integrate nature-related risks and opportunities into our investment processes, aligning with the recommendations put forth in the independent biodiversity study, “The Economics of Biodiversity: The Dasgupta Review.”[5] It is our way of acknowledging that a sustainable future is a shared responsibility that extends from government commitments to the financial industry and beyond. We’re not just talking about it; we’re actively working towards a nature-positive world.

Nature: The Bedrock of Our Well-being

The value of nature is immeasurable. It is the foundation of our economies, our livelihoods, and our overall well-being. Nature provides us with vital ecosystem services, sustains our health through pharmaceutical discoveries, fuels industries, and offers us aesthetic and cultural enrichment. Yet, despite its profound importance, the true value of nature has often been ignored in economic models, leading to the overexploitation of natural resources.

We firmly endorse the perspective put forth by “The Economics of Biodiversity: The Dasgupta Review” that we are not external to nature but deeply embedded within it. Our future prosperity and survival depend on this realisation, and we are committed to acting on it.

MAM’s Biodiversity Policy: A Blueprint for Positive Change

Our Biodiversity Policy is structured to ensure that nature-related risks and opportunities are seamlessly integrated into our investment process. Here’s an overview of key components:

- Biodiversity in ESG Analysis: We have incorporated biodiversity considerations into the environmental section of our proprietary ESG checklist. This includes assessing a company’s exposure to operations that disturb land or ecosystems, operations in ecologically fragile regions, biodiversity and land use exposure, and the presence of a biodiversity policy. Our ESG scoring system informs our overall assessment of a company’s impact on biodiversity and guides our engagement efforts.

- Positive Impact and Biodiversity: Companies considered for investment in our global impact portfolios must align with one or more of our impact themes. Notably, Environmental Protection is a theme directly tied to United Nations Sustainable Development Goals (UN SDGs) 14 (Life Below Water) and 15 (Life On Land). We focus on sub-themes such as pollution control, water treatment, waste recycling and management, as they contribute to measurable positive impacts on biodiversity.

- Taskforce on Nature-related Financial Disclosures (TNFD): We actively engage with the TNFD framework, a science-based approach to measuring, reporting on, and protecting global nature. We participated in the framework’s development, offering feedback and insights, and are now working to assess the impacts and dependencies of our investee companies using the framework’s methodology. This process may experience some delay due to current underreporting of biodiversity data, but we are committed to full alignment and will publish a TNFD statement when our analysis is complete. Our membership of the TNFD Forum reinforces our dedication to its mission.

- Stewardship and Engagement: We leverage our ESG analysis to identify engagement priorities, advocating for reduced negative impacts and the pursuit of solutions related to nature. We stay informed about emerging best practices and market developments to inform our engagement efforts. We also promote the importance of nature-related reporting and action among investee companies and encourage them to adopt the TNFD framework.

- Protecting Nature at MAM: Beyond investment practices, we are actively engaged in conservation efforts. We have partnered with Rewilding Britain, supporting rewilding projects that restore ecosystems and habitats. We also champion Tribal Survival, a charity dedicated to the well-being of Indigenous peoples who play a critical role in safeguarding nature. Additionally, we contribute to urban pollination efforts by hosting beehives on our office roof in central London.

A Policy with a Future

MAM’s Biodiversity Policy is not a static document; it is a living commitment to a sustainable future. We understand the importance of continuous improvement and accountability. Therefore, this policy will undergo annual reviews or more frequent evaluations as needed, ensuring that our actions remain aligned with our vision for a thriving planet where nature and humanity coexist harmoniously.

We invite you to join us on this journey towards a more sustainable and nature-positive future. Together, we can reshape our relationship with nature and create lasting positive change for our world and future generations.