Making renewable energy with finite resources

Constraining factors to decarbonisation

Modern society depends on the widespread availability of reliable and affordable energy services in order to function and to develop equitably. Our energy system is the bedrock of productivity across all sectors of the economy. The use of fossil fuels and the subsequent greenhouse gas emissions that are associated with industrialisation have to be replaced with clean and sustainable sources of energy in order to facilitate social development that does not come at an unmanageable planetary cost.

However, it is not right to say that the manufacture, construction and operation of renewable energy assets comes without environmental damage. The sourcing and processing of the necessary raw materials to develop clean energy solutions have an ecological and climate footprint too. The question is, to what extent do these negative externalities impact the decarbonisation plans put in place by governments, businesses and other organisations?

Making the green economy circular

The selection of materials for the generation of renewable energy and shift to Electric Vehicles (EVs) should be carefully considered. Taking into account the circular economy and ability to create an asset that is capable of going from “cradle-to-cradle” (from one useful product to another in a cycle without waste) is an essential part of the green economic transition. Unfortunately, this has not been a principle focus for renewable development in the past. This does appear to be changing, industry groups such as WindEurope are working to improve what happens to key components at the end of their useful life. One initiative that recently was adopted by the WindEurope membership, was prohibiting the sending of wind turbine blades to landfill from 2025[1]. Approximately 85–90% of a wind turbine can be recycled or reused. The main challenge is the rotor blades, which consist mainly of a composite material that is currently difficult to recycle cost-effectively and without generating high emissions[2]. Steel and iron account for 80–90% of the weight of a wind turbine and are mostly found in the tower of the turbine. The height of the tower affects how much steel and iron is used. Fibreglass composite generally accounts for 5–8% of the weight and is used mainly in the blades. Plastics account for 3–4% as well as aluminium and electronics[3]. Turbine manufacturers such as Vestas are aiming for zero-waste wind turbines but at present 85% of a Vestas wind turbine is recyclable.

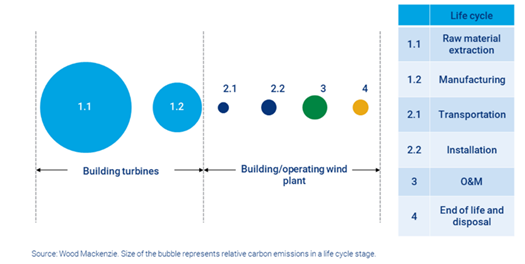

In addition to recycling efforts, the building of turbines has an associated carbon cost. The figure below shows the distribution of energy required over the life span of wind turbines and indicates that raw material extraction is by far the most environmentally costly.

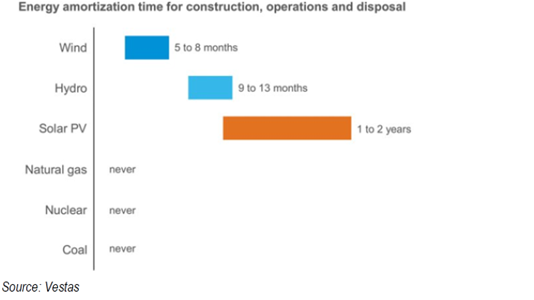

However, energy payback cycle is essential when considering the overall carbon debt of a renewable asset. This is the idea that wind turbines and solar panels will pay back the energy and carbon production cost over the course of its useful life. The chart below shows the speed at which the carbon cost is repaid by different assets, with wind having the shortest payback time.

As with wind turbines (and any manufacturing process), solar panels also require energy and materials to make. This means that their production is not climate neutral. However, a typical solar panel will save over 900kg of CO2 per year, that results in a carbon payback period of around 1.6 years[4]. When these panels are decommissioned, the problem of how to recover useful materials for reuse is a challenge. Over 95% of PV modules deployed in the U.S have been installed since 2012, and such modules will stay in service for more than 25 years. As a consequence, the problem of decommissioning is still a new problem and so the infrastructure is under development. Until there’s a steady stream of spent solar panels, it will be hard for recyclers to focus more of their business on this inflow. In order to prepare recycling companies for an influx of panels, trade groups associated with the solar industry are creating programs to train commercial recycling companies[5]. In addition to the development of recycling methods, companies are beginning to design panels that are conducive to recycling. For some new panels, it is estimated that up to 90 percent of the glass and semiconductor material in its decommissioned panels can be reused in new panels or other glass products[6].

Mining for a cleaner future?

Beyond the recyclability of turbines and solar panels, an area that has caused concern is the reliance on metals such as copper to complete the electrification necessary to move away from fossil fuels whilst still meeting our energy needs. The electrical conductivity of copper has meant it has been used as an important material for producing and distributing power since the days of Edison and Tesla. This reliance has continued into the modern day with the demand for copper increasing due to electrification (in part due to a green economic shift) and population growth. According to forecasts from BloombergNEF, the global power grid will grow by 48 million kilometres by 2050. That’s enough to wrap around the circumference of the Earth nearly 1,200 times and equates to a doubling in copper demand to 3.6 million metric tons[7]. This increase in demand will impact prices, which may jeopardise progress towards decarbonisation. There is also concern over how this increase in demand could lead to scarcity due to the lack of investment into the exploration of new copper deposits and long lead times for mine development will prevent the industry being able to ramp up production[8]. In addition to the financial cost of opening new mines, the extraction, smelting and purification process of copper ore comes with a big environmental price tag.

With this in mind, the topic of recycling comes to the fore again. It seems inescapable that the reuse of materials will have to play a growing part in the energy transition to bridge any shortfall unmet by extraction[9]. The good news in relation to copper is that it is one of few materials that can be recycled repeatedly without any loss of performance. There is no difference in the quality of recycled copper and mined copper and so they can be used interchangeably. In Europe, it is thought that over 50% of copper comes from recycled sources[10]. In addition, the recycling of copper requires less energy than primary production and so emissions associated with reclamation are reduced in comparison to extraction, and this method is less ecologically damaging as there is no hard-rock mining[11].

The trouble with batteries

Another metal of particular importance is lithium. Lithium is an essential component of lithium-ion batteries (LIBs). Those batteries are needed for EVs and energy storage to smooth out the supply of electricity from renewable sources. There are a number of concerns over our growing reliance on the supply and delivery of lithium:

- Most production today is concentrated. For example, in 2020 Australia was responsible for the lion’s share of global lithium production, associated with 48% of the global total[12]. Bottlenecks such as this for lithium and other metals used in battery technologies (such as cobalt) are a source of risk to the supply chain.

- Increased demand is putting pressure on prices. While the cost of batteries has declined over the past decade, supply chain constraints and increasing demand are causing prices to stagnate[13]. In 2015, the raw materials used in manufacturing batteries accounted for 40% of the cost, but in 2022 that has increased to upward of 80%[14].

- Supply Shortages. In just a few years, demand for lithium-ion batteries increased from 59 gigawatt-hours (GWh) in 2015 to 400 GWh in 2021[15]. That demand is set to increase at an accelerating rate with the adoption of EVs, particularly if we meet the trajectory necessary to achieve net zero by 2050.

It is possible that battery recycling can mitigate some of the production shortages. But, unlike copper, there are more challenges associated with the salvage of lithium from existing LIBs as they are highly flammable and this makes the dismantling process difficult. In addition, the infrastructure for large scale recycling and recovery is still not in place. As a consequence, recycling is currently more expensive than extraction.

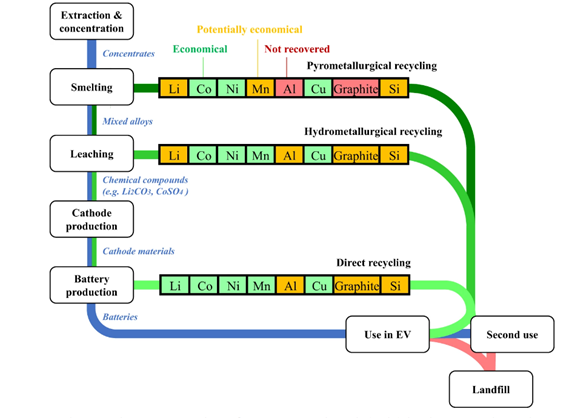

Above is a conceptual schematic showing how three recycling scenarios close battery material loops and which materials are recovered. There is also an evaluation of current economic viability for each recovered element. This shows that the most economically and environmentally promising technology for closed-loop recycling is the direct recycling route, although this is still in its infancy [16].

Whilst battery recycling remains a complex problem, issues surrounding the upstream supply chain have been a focus for the Global Battery Alliance. In January 2023, at the World Economic Forum meeting in Davos, the Alliance showcased its new “battery passport” initiative. The passport uses a digital twin of a physical battery to provide detailed information on where and how composite materials and parts and been made and sourced. This digital twin is then compared to sustainability criteria and data on carbon footprint, child labour and human rights performance. The aim is to improve transparency and enable customers to make more informed purchasing decisions that take into account sustainbility credentials[17].

The role of regulation

Regulatory pressure is being exerted on the recycling system to help accelerate the development of cost effective retrieval methods. Waste Electrical and Electronic Equipment (WEEE) recycling is a specialist sub-sector that is now closely regulated to prevent the waste being incinerated or sent to land fill. The EU (and the UK as a result of its previous membership) introduced rules to address this waste stream with the aim to contribute to sustainable production and consumption. They address environmental and other issues caused by discarded electronics and place obligations on producers and distributors to reclaim their products and reuse them in the supply chain[18],[19]. The EU have subsequently built this into their circular economy action plan[20]. The regulation captures the manufacturers of renewable energy components (particularly photovoltaic arrays) and batteries. This is an important part of the development of infrastructure that is needed to create a closed-loop, green system. In addition, the circularity action plan includes a legislative proposal regarding the sustainability and transparency requirements for batteries. This takes into account the carbon footprint of battery manufacturing, the ethical sourcing of raw materials and security of supply, as well as facilitating reuse, repurposing and recycling[21].

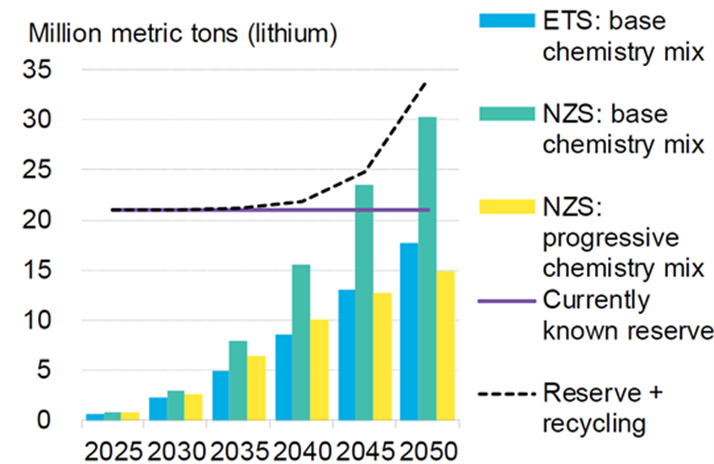

In addition to the recovery of assets in line with circular economic principles, it is also possible that new technologies could be developed that mean the composition of batteries is less reliant on metals that are likely to experience a shortfall if current consumption patterns continue. For example, battery manufacturers are already seeking to decrease their reliance on cobalt by lowering the cobalt content of their chemistries, proving that opportunities lie in the development of battery technology[22]. The chart below shows the assumed cumulative lithium demand and reserves under different chemistry mixes and decarbonisation scenarios.

Source: BloombergNEF.

This model compares an Economic Transition Scenario (ETS) which assumes no new policy intervention, with a Net Zero Scenario (NZS) which investigates what is needed to achieve carbon neutrality by 2050. The different scenarios show how advances in recycling[23] and chemistry could help to meet demand under a NZS by 2045 when it is predicted to surpass current known lithium reserves using existing technology.

It is also possible that the development of alternative fuels (such as hydrogen) will help to decarbonise transport systems whilst alleviating the supply chain pressures currently seen on LIB manufacturing.

Conclusion

The idea that we should stop moving towards renewable energy and away from fossil fuels due to the difficulties associated with resource extraction and recovery as well as the associated energy cost ignores the overall negative impact of continuing with the status quo. The extraction and burning of fossil fuels has a bigger negative impact on the planet than renewable energy[24]. EVs also have a reduced climate impact compared to internal combustion engine vehicles[25].

Whilst we should, of course, be aware of pinch points within supply chains and factor the energy needed for manufacturing and operation into the overall carbon footprint of the finished asset or product. This should not be used as an excuse for inaction on the climate crisis. Over the life of a wind farm or solar park (20 to 30 years) emissions to land, air and sea are avoided whilst energy is produced to power society. It is clear that the fuel needed for sustainable development should be renewable. Supply challenges can be addressed through, not only the opening of new mines in new locations (which of course comes with high levels of environmental risk which should be factored into these new operations), but through investment in recycling efforts, developing alternative battery compositions to avoid unfavourable burden-shifts, and designing products with circularity in mind so they are easier to dismantle and extract valuable materials from once they reach the end of their useful life.