COP26 and the Day I Met John Kerry

Sir David Attenborough; our work on the GFANZ taskforce; co-chairing the B Finance Coalition; and a meeting with US Climate Envoy John Kerry.

“Is this how our story is due to end? A tale of the smartest species doomed by that all too-human characteristic of failing to see the bigger picture in pursuit of short-term goals”.

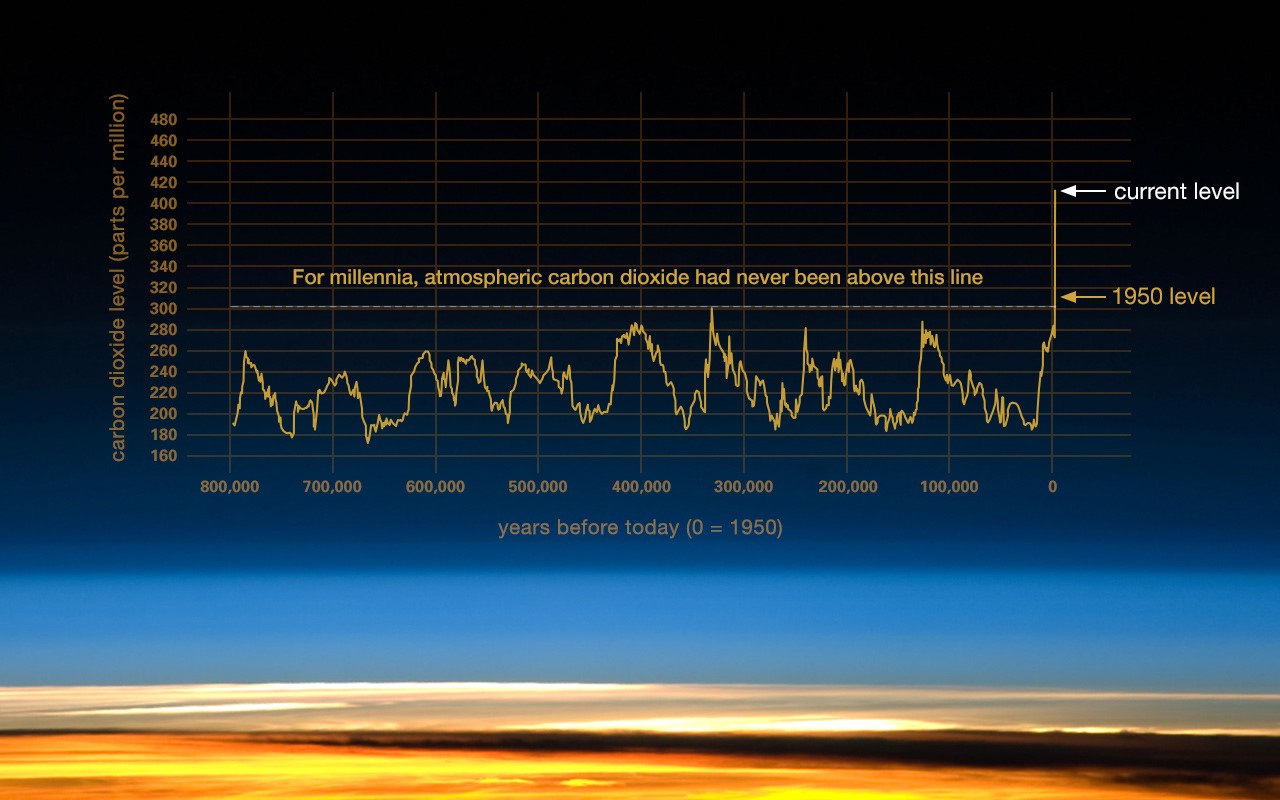

This statement, taken from a speech delivered so powerfully by Sir David Attenborough at the start of COP26, served as a stark reminder of what is at stake. Amid the strains of political negotiating, the sharp voices of protestors on the streets of Glasgow, the comings and goings of official observers, the innovation on show in the Green Zone, and the inspiration of fringe events hosted by NGOs, charities and the private sector, his words struck a chord due to their scientific simplicity: “It’s easy to forget that ultimately the climate emergency comes down to a single number — the concentration of carbon in our atmosphere”.

Montanaro was fortunate to play a small role at COP26 and it is something that we will remember, probably for the rest of our lives. A plethora of announcements have been made: new net zero targets; pledges to reduce fossil fuel finance; commitments to phase out coal production; methane reduction goals; promises to end deforestation; guarantees of vast amounts of capital. Each greeted with celebration and critique. Targets, pledges, commitments, goals, promises, guarantees… So much noise. It was easy to get lost amid the cacophony.

As Sir David said, “it’s easy to forget…” what this all comes down to: atmospheric CO2 levels have reached 414 parts per million, a level that is unprecedented in human history. Climate change is already with us and every decision we take – every decision – will now determine if this number continues rising, or falls, as it surely must.

What was Montanaro’s contribution to COP26? How can we help to pull this atmospheric figure down in the months and years ahead?

Montanaro has been one of the few boutiques to have contributed to the work of the GFANZ taskforce (this is different to merely signing up to the GFANZ net zero commitment, which most asset managers under the sun appear to have done). Specifically, we are part of workstream three, which focuses on Real Economy Transition Plans. This work was included in GFANZ’s inaugural Progress Report, published as the group’s chair, Mark Carney, spoke at Finance Day. While the assets committed to GFANZ’s 2050 net zero carbon target stole the headlines – it is not every day that you can say $130 trillion of capital is committed to the net zero journey, even if critics were right to point out that this is not a climate war chest, it is just an assets under management figure – this headline overlooked some of the more important work GFANZ has been focused on, namely providing improved guidance on how companies should plan and report on their transition to net zero.

This work is hugely relevant to a multi-year engagement deep dive that our investment team is working on: Project: Net Zero Carbon, an ambitious project aimed at encouraging our investee companies to achieve net zero as rapidly as possible. Data gaps and a lack of consistency in reporting are problems that every investor confronts. GFANZ is aiming to bring existing frameworks together: Assessing Low-Carbon Transition; SBTi; CDP; Climate Action 100+; TCFD; Transition Pathways Initiative; and suggest how companies can best utilise what already exists in the market. It is not about reinventing the wheel.

We were also thrilled to be part of the B Finance Coalition, which we have co-chaired alongside EQ Investors. This group of 11 finance firms, spanning centuries-old banks to fintech start-ups, made a significant call to action, asking finance firms to join them and amend their constitutional documents to align with broader stakeholder needs. As B Corporations, we have all done this and believe it leaves our businesses better placed to tackle the climate crisis. Whoever is on our Board will have to ensure that the business is being managed in a way that delivers social and environmental good, now and in the future.

Perhaps the biggest takeaway from COP26 – amid all the noise and announcements that now clearly need to lead to urgent action – was the sense of collaboration from stakeholders of all kinds. We witnessed this first-hand, amid the throng of protestors outside the Blue Zone, and within the B Finance Coalition, which brought together peers who in a different context may view one another as industry competitors. There is space for us to all learn from and work with each other to help solve huge global challenges.

We also saw collaboration at the international level. Despite huge differences in many other areas, the US and China issued a joint statement on target setting, urging other countries to update their emissions targets by the end of 2022. This is significant and is due to hours of talks between China’s top climate negotiator, Xie Zhenhua, and his US counterpart, John Kerry.

On a personal note, something that will stay with me was a chance meeting with Mr Kerry, a former presidential candidate and now Special Presidential Envoy for Climate, a newly created role. His enthusiasm, dedication and experience will be needed more than ever to cajole the international community into taking the necessary action to tackle climate change.

Something that he said recently has stayed with me: “this is not a discretionary thing, frankly, this is science, it’s maths and physics that dictate the road that we have to travel.”

It is a road that we all have to embark on and the private sector must play its part with more urgency than ever. As managers of the Montanaro Better World Fund, we are doing what we can to shift capital to those businesses providing the products and services that can deliver a greener, net zero economy.

As Sir David Attenborough said in his speech, “a new industrial revolution powered by millions of sustainable innovations is essential and is indeed already beginning. We will all share in the benefits of affordable clean energy, healthy air and enough food to sustain us all. Nature is a key ally, whenever we restore the wild it will recapture carbon and help us bring back balance to our planet”.

Wise words from a memorable conference. The talk is almost done. Now is the time for rapid action.