Capital Markets Reform: A Vital Transfusion for the Lifeblood of the UK

UK SMidCaps represent the lifeblood of the UK, a diverse array of businesses that reflect the real economy, and their success or otherwise therefore directly impacts the prosperity of the country at large in a way that the FTSE 100, concentrated in exporters whose companies derive 75% of their revenues from overseas, does not.

Amidst a rising trend of de-globalisation and national protectionism, the UK has been a notable outlier in its absence of support for its domestic market. China has recently been stepping in to support domestic shares through investments from state institutions (as well as short-selling restrictions), whilst part of the resurgence in the Japanese equity market has been attributed to the Nippon ISA that has been supporting domestic retail flows. France has a PEA plan that allows individuals to invest up to €150,000 tax-free in French or EU stocks with an additional scheme for SMEs. Even Donald Trump during his time in Office often seemed to equate the performance of the S&P500 with an opinion poll as he encouraged the Fed towards rate cuts, understanding the important wealth effect of the domestic stock market given so much of the population has exposure to it through their pension pots.

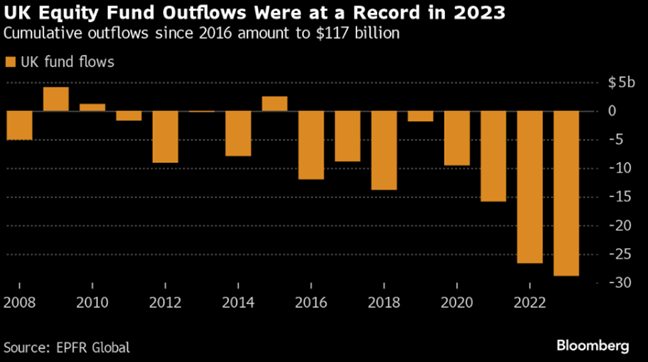

Yet with the TOPIX near all-time highs and the S&P500 continuing to rerate, investors pulled a record $28.8bn[1] from UK equity funds last year: Whilst retail participation in domestic equities has roughly halved over the past decade, the lack of capital markets support from the country’s institutional investors has been palpable. A recent CMIT report[2] highlighted that since 2000, the share of the UK stock market owned by UK pensions and insurance companies has fallen from 39% to just 4% in 2023.

Whilst retail participation in domestic equities has roughly halved over the past decade, the lack of capital markets support from the country’s institutional investors has been palpable. A recent CMIT report[2] highlighted that since 2000, the share of the UK stock market owned by UK pensions and insurance companies has fallen from 39% to just 4% in 2023.

However, just as we were beginning to wonder if the Chancellor also went by the name of ‘Godot’, the March Budget brought with it some welcome potential respite for the UK’s beleaguered market. Amongst a number of key proposals made by the government we noted:

- The introduction of a British ISA to encourage retail investors to invest in UK stocks;

- Increased transparency of pension fund asset allocations, with a variety of initiatives to encourage a better balance of riskless and risk assets (including 5% in unlisted equities)

- Reducing bureaucracy around regulation for listed entities;

- A new trading system for private companies (‘PISCES’) to support earlier stage capital raising/investing

We were fortunate to attend an event at the London Stock Exchange recently, hosted by broker Cavendish, at which Economic Secretary to the Treasury Bim Afolami MP made a passionate case for the much-needed capital markets reforms, particularly targeted at SMidCaps. He highlighted the ongoing debate in Canada about the need to increase their own pension fund domestic equity ownership from its current 12% (around triple the UK’s current allocation). The government is set on reducing friction in the system and supporting investment into companies that form the lifeblood of our economy. More than anything this impressively well-attended event was a timely reminder that hope is not lost and that there is growing momentum across investors, corporates, and the government itself to make the fundamental changes necessary to make the UK equity market a national champion again.

At Montanaro we support these efforts to stimulate the domestic stock market and firmly believe in the virtuous circle that can form around reducing the cost of capital for UK corporates, thereby stimulating investment, hence stimulating growth, thus supporting higher valuations, which in turn reduces the cost of capital and so on. The potential for more Foreign Direct Investment from higher international interest in UK plc and the benefit this can have for both the currency and the economy is also apparent. The media can play an important role in shifting negative perceptions around financial services towards the wealth effect that benefits the population as a whole; ultimately a more positive narrative can build a more positive perception and therefore reality.

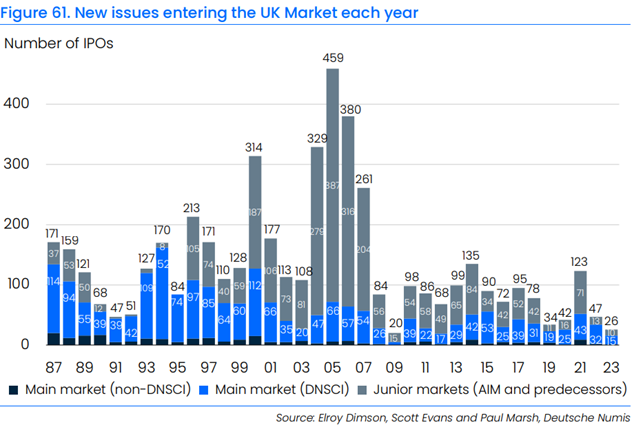

We do however believe that the current proposals represent a necessary but not sufficient step in the right direction. Friction in the market remains high; the UK remains an outlier in its high stamp duty for trading UK shares, whilst our investee companies continue to lament the increasing costs of compliance including the ever-greater costs of obtaining an audit. Whilst our funds have been benefiting from gains resulting from the takeovers of undervalued UK SmallCaps by foreign participants, the recent takeover agreement of Spirent Communications at a 61.4% premium being a case in point, we believe a healthy and vibrant listed SMidCap market is essential to the long-term prosperity of the country at large. Essential to this is an urgent need to reduce the friction that has driven a sharp contraction in new listings in recent years. Since 1987 the average number of annual IPOs in the UK has been 134, yet post-2008 the figure is 75 and in 2023 this shrank to just 26[3]: Without a concerted effort to foster a more conducive environment for companies contemplating a domestic IPO, the UK risks a further decline in the number of listed companies and the shrinking liquidity that can result from this. However, with a targeted reduction in bureaucracy and cost, there is the potential to transform a vicious circle into a virtuous one and we will continue to advocate all positive change that will support a re-rating of this unloved asset class.

Without a concerted effort to foster a more conducive environment for companies contemplating a domestic IPO, the UK risks a further decline in the number of listed companies and the shrinking liquidity that can result from this. However, with a targeted reduction in bureaucracy and cost, there is the potential to transform a vicious circle into a virtuous one and we will continue to advocate all positive change that will support a re-rating of this unloved asset class.

[1] Pham et al, Bloomberg. March 2023

[2] Wright, William. Unlocking the capital in capital markets. March 2023

[3] Dimson, Evans & Marsh. Deutsche Numis Indices 2024 Annual Review. January 2024