Bubble or Bull Market: The Post-Covid Age of Real Profit Growth

At Montanaro, we are bottom-up stock pickers. We wish we were clever enough to make grand macroeconomic predictions, but we have resigned to the fact that the best insurance policy against the ebbs and flows of the macro environment is backing great companies.

But now we find ourselves with a seemingly more expensive investable universe going into 2021, especially in certain sectors like technology, and we are asking ourselves: should we be worried?

Some market commentators may yell ‘Bubble!!’, but we think it is at least worth considering what fundamental changes in the real economy could be driving the eye-watering outperformance of certain stocks. Here goes…

Fiscal Stimulus: Bottom-Up Capital Growth

In a year of hyperbole and “unprecedented this/unprecedented that”, it seems to me the change in fiscal philosophy has been the biggest of them all. I suspect that this is the single biggest fundamental driver of current stock valuations, especially in intangible-asset-heavy businesses, and I expect this momentum to continue.

Why?

Forget for a moment bond yields and QE and interest rates and inflation. Forget everything else just for a moment because the delta of all of these pales in comparison to the magnitude of change that 2020 has in fiscal policy.

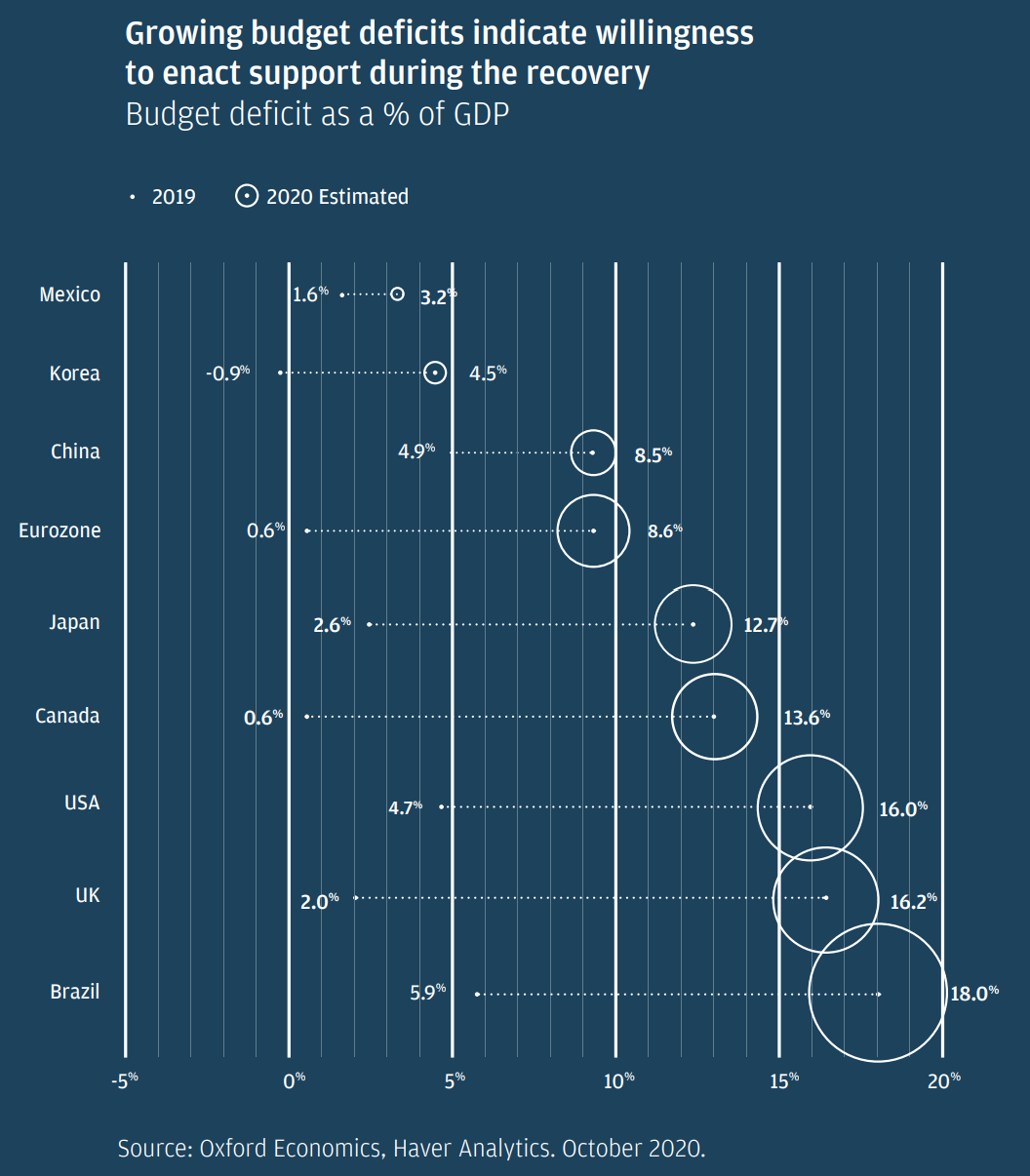

The US and the UK are projected to be running 16% budget deficits. These projections were made before the Democrats won the Senate, and before the UK went into another hard lockdown. These things will propel the deficits up even further (closer to 20% for the UK given Q1 GDP is forecast to shrink) as the Treasury further turns on the taps, and Congress passes $2k stimulus cheques.

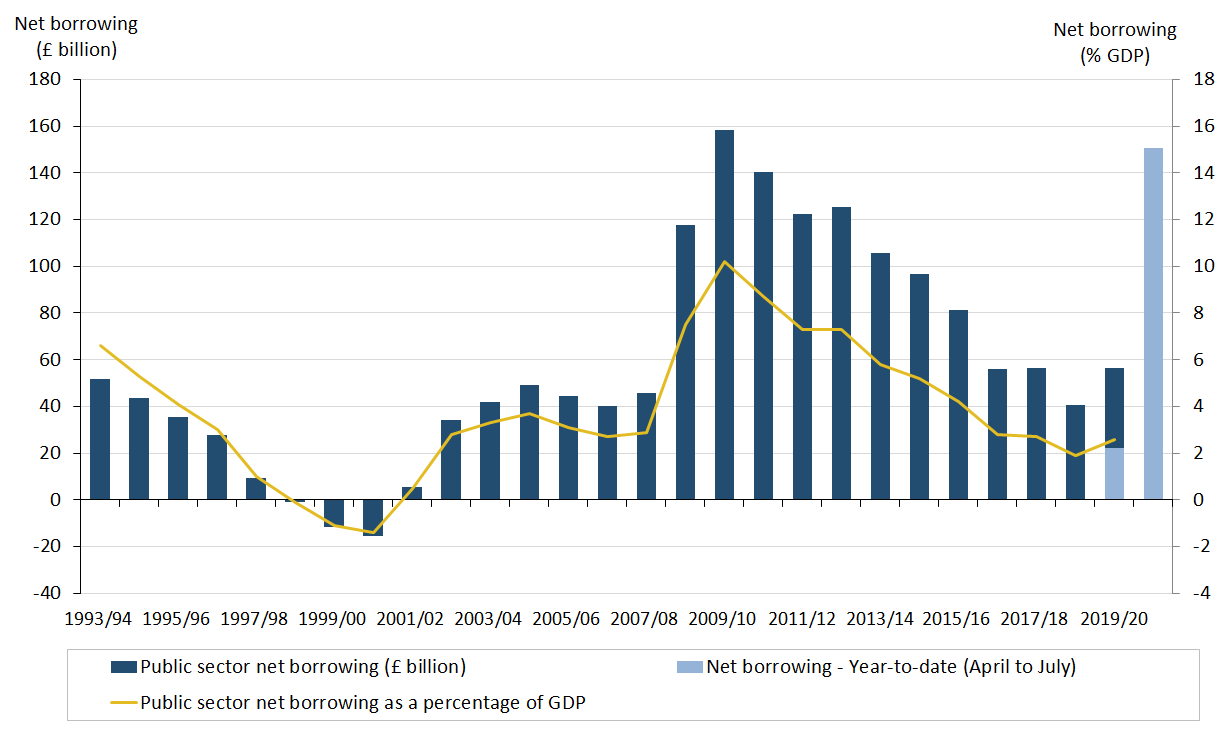

Source: Office for National Statistics, UK

As you can see, a budget deficit that might approach ~20% is a big deal. I only have reliable numbers going back to 1993, and no year has been close to this level of fiscal stimulus. Covid will have resulted in even more relative fiscal stimulus than the GFC. And the GFC was a far worse crisis of fundamental shocks to supply and demand. I say ‘fundamental’, because there is a difference between demand being shocked because I am forced to save my money, and demand being shocked because I’ve lost my money. And far from a credit crunch this time round, the banks are surprisingly well-capitalized.

I’m not saying everyone is better off than they were in 2019: and every sector has been supported to a different degree (services vs retail vs airlines vs manufacturing).

But one shudders to think of the hypothetical difference between the savings rate of households this year, and what it would have been without this scale of fiscal stimulus.

So really nothing can overstate the magnitude of policy shift this year. Onto what it means….

The Shortcomings of Monetary Policy in 2021

We are all used to talking about the effects of monetary expansion as a stimulant to the economy and the market. Truly it is, but monetary policy has only indirect effects on investment flows. In macroeconomics it has a second order effect via the way inflation expectations affect spending (something which is becoming increasingly moot) and via borrowing and spending decisions. The mechanism of monetary stimulus is to stimulate investment by lowering credit cost etc.

The increasing shortcomings of (especially isolated) monetary stimulus (at least in its marginal utility) have been scrutinized by countless academics and articles in the last decade. A quick google search will reveal an abundance of literature on the liquidity trap at the zero lower bound.

Zero Lower Bound only makes sense as a stimulant with fiscal stimulus

That monetary policy at the Zero Lower Bound becomes ever-less impactful is the very reason behind Central Bank asset-purchasing programs. Near the ZLB, lower rates in and of themselves stop making a meaningful difference the real economy: hence the need for asset-purchasing for incremental liquidity.

But even perpetual bond-purchasing by the Federal Reserve cannot continue to stimulate real-world investments, when the capital allocation decisions become overly concentrated in the hands of large cap CEOs.

Surprise Surprise: such monetary policy incentivizes capital allocation towards buybacks and dividends over real investment. This effect becomes greater with every incremental unit of bond-purchasing, to the point of having no impact on real productivity and real profit growth.

But what happens if we change strategy, and rely on more bottom-up capital allocation to drive real economic investments?

Enter Fiscal Stimulus

The way you get out of the liquidity trap at zero rates, and the only way you can stimulate real capital investment after bond-buying markets are saturated, is fiscal stimulus. This is the only way Helicopter Money1 can actually work: if the primary consequence of central bank monetary stimulus becomes financing the budget deficit, and if that budget deficit makes its way into the Household Sector (more on this soon). The point that everyone is now realising is that our current 16% deficit is only serviceable on account of monetary policy.

Next point: Fiscal Stimulus does not merely bring about investment. It is investment. And it has a much quicker impact than monetary stimulus.

In macroeconomics, ‘Investment = Savings’ is a well-known identity.

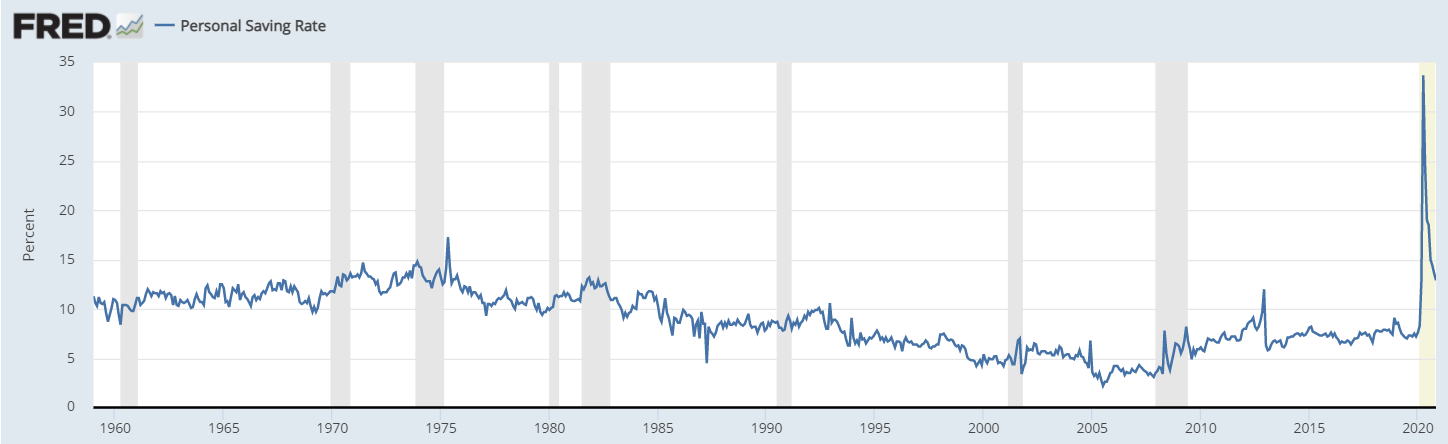

Fiscal stimulus directly goes into the savings/investment identity. Think of those $2k stimulus cheques going straight into people’s pockets. That money will be either spent immediately or is saved as future expenditure. We saw this with the last round of stimulus cheques in the US:

If Savings = Investment, this portends much greater household spending in the next time period. But the crucial point is: fiscal stimulus takes effect much quicker than monetary stimulus.

You see the spike in the savings rate instantly reducing from the Spring stimulus round in the U.S: at least part of incremental household income is spent immediately.

By contrast, For those wondering how quickly capital gets allocated when you get over-bearing monetary stimulus sending liquidity to corporates, have a look at Japanese balance sheets…

Deficits Boost Profits in the Private Sector

As investors we are in the business of profits. But where do profits actually come from in the private sector?

Take the whole economy as a whole, not an individual company: what affects the aggregate pool of profits?

The Kalecki-Levy Profits Equation shows us in detail how financial profits ultimately depend on the balance of trade with the foreign sector, the balance of the government sector, and the balance of the household sector (consumer saving vs spending). For a detailed explanation, this is an excellent piece: Where do profits come from?

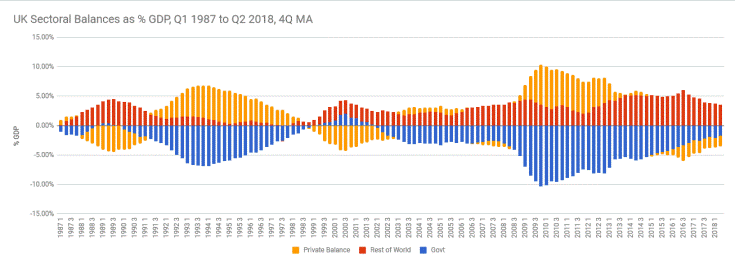

The important identity is that of the balance of sectors:

Government Budget Deficit = Private Sector Surplus

And a private sector surplus (saving) = investment = profits.

We see the former balances identity in the data, also:

This is also all common sense. Corporate PnLs have been saved by the furlough scheme both on the bottom line, and on the top line by the household sector spending (thanks to furlough payments and stimulus cheques and tax deferments etc) driving revenue growth.

What about the future of fiscal spending? Don’t investors care more about the second derivative?

What is unquestionably true is that fiscal policy will have to be consistently expansionary for at least the mid-term, for this all to make sense. It’s no good if state deficits swing to surpluses in a year. My answer to this is to suggest that the reason the markets were so excited by a Democratic Congress, and now a Democratic Senate, is that an expansionary fiscal policy is set to be firmly in place for the next 4 years.

Politics has changed, and one struggles to imagine the Democrats proposing $2k stimulus cheques in 2009. But they are doing it now, and it shows they mean business. As for the UK and Europe, I don’t remember the last time I heard the word ‘austerity’ from any government, and historically the U.K and Europe have followed the tone set in the U.S. Not to mention that a decade of macroeconomic literature has debunked most of the austerity-first policy myths.

INTANGIBLE ASSETS (read on…)

So, based on the above there is good reason to think that 2021 will see record investment growth and record corporate profit growth on aggregate.

There is credit capacity; there is a high savings rate in the household sector; and thanks to the state sector deficit, the private sector is also in relative surplus, meaning there is a higher savings rate in the private sector, too.

BUT: won’t this cause economic overheating, GDP growth, and therefore a “dash for trash” value stock outperformance?!

Well this is the billion dollar question, but I think the answer is: no it won’t.

Why might “dash for trash” not happen? Enter Stage Left Intangible Assets.

All the mechanisms described hitherto boost financial profits via private sector investment into capital expansion (which in turn creates new jobs and new household revenue etc).

–> But we live in the age of intangible assets (patents; R&D; software; consumer entertainment; creative IP; ), and 2021’s corporate investment spike will be skewed towards intangible assets.

—> This is explained both on the supply side, but also on the demand side when one considers that a growing proportion of the household’s sector’s spending is going towards businesses with higher % of intangible capital on their balance sheets. i.e. It is going towards more Montanaro-style businesses.

Capital Allocation: The Old Model vs The New Model

With a monetary policy-first stimulus response (low rates + asset purchasing), asset allocation decisions get concentrated in the hands of large cap CEOs. We covered this earlier.

But when you have a fiscal-first stimulus that sends cheques straight to the household-sector, the 350 million people in the United States become the asset-allocators. They spend where they want to spend, and those sectors reap the rewards.

We think that in a world of increasingly bottom-up capital growth where the household sector leads the flow of capital, coupled with state-led funnelling of capital into strategic areas (like Life Sciences R&D and Renewables), then the old world of low quality, low intangible capital ‘value’ stocks will lose out with even greater force than it has done historically, propped up by the old model of loose monetary stimulus.

Caveat: this is not to say that only technology stocks will do well. Clearly the capital investment in intangibles will create additional household spending, of which some will of course go to traditional businesses with tangible capital balance sheets. Industrials will likely do well; consumer discretionary goods will likely do well; autos may have a strong year, too. 2021 will be full of opportunity.

But such is the skewed nature this particular cycle of capital investment in favour of intangibles that I don’t anticipate a dash for trash in a way that sees quality growth underperform meaningfully over any prolonged length of time.

Yes, many quality growth stocks are much more expensive than they were last year: this is why we bought them last year. And yes we will have to be even more diligent with valuations. But for anyone thinking that current quality growth outperformance is without good fundamental cause, they should perhaps view the current shift in macroeconomic policy in its historic context.

Final Question: Does this mean that we should expect quality growth to outperform again in future recessions, if such recessions are met with similar fiscal stimulus?

This is an interesting thought to end on. Perhaps this will indeed prove to be true. If the future model of recession combat is sending money straight to households, then, I repeat, the household sector drives capital growth. This means that the main beneficiaries in such a scenario will likely be the existing growth stocks of the time.

But as with everything, only time will tell…

P.S. Perhaps another blog post will address why inflationary pressure is not likely to climb in any significant way; but in short, it is the very concentration of capital in intangible assets and technology that is deflationary. Think of the diminishing marginal cost of renewable energy; think of the price of the new iPhones and the new M1-chip Macbooks; think of the effect of e-commerce on consumer prices.