Beyond Calories: Investing in a Healthier Future

A recent study published in The Lancet has found that more than a billion people around the world are obese. This suggests an urgent change is needed in how we address issues facing our food system.

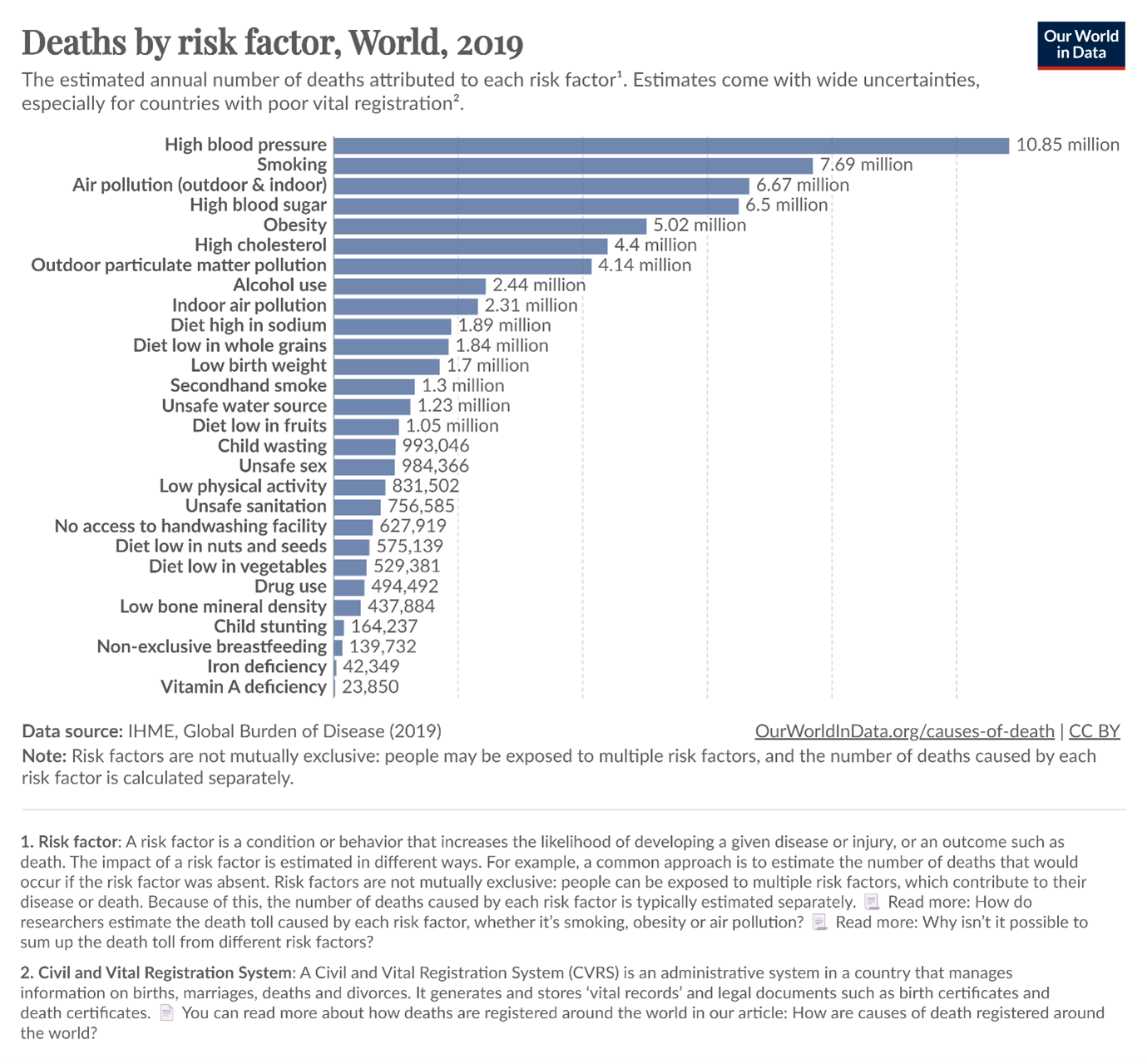

The impact of diet on health outcomes is profound. It is estimated that around 5 million people died prematurely in 2019 as a result of obesity, which makes it one of the leading causes of death worldwide. This pressing problem demands informed policy-making, responsible corporate conduct, and strategic investment.

This pressing problem demands informed policy-making, responsible corporate conduct, and strategic investment.

The new coal?

In an era where a focus on health and sustainability is paramount, an analogy between junk food and coal appears particularly apt.

Just as the shift away from coal requires global cooperation and policy interventions to promote renewable energy, addressing the public health impact of unhealthy food requires systemic change. This includes policy measures to regulate the marketing of unhealthy foods, initiatives to improve the affordability and accessibility of healthy food options, and education programs to raise awareness about nutrition.

In comparing unhealthy food to the new coal, it’s important to clarify that the focus of this comparison is on the systemic issues related to the production, marketing, and availability of unhealthy food options, rather than demonising individual choices or behaviours. There are complex cultural, economic, and environmental factors that influence dietary habits, and the conversation should focus on the role of the food industry and policy in shaping health outcomes.

Weight loss drugs

Glucagon-Like Peptide-1 (GLP-1) drugs such as Ozempic have become a popular choice for weight management and have garnered much press attention. GLP-1 mimic a hormone in the body that helps control blood sugar and appetite. This can help manage diabetes by keeping blood sugar levels more stable and can also help people lose weight because they feel less hungry and full more quickly.

Such medications are viewed favourably by many ESG-focused investors for their role in combating obesity and its related health complications. In improving health metrics and easing the strain on medical systems due to obesity, GLP-1 drugs meet the ‘Social’ criteria within ESG mandates. Nonetheless, the discussion is nuanced, as the high cost and variable accessibility of these drugs, especially in the U.S., create barriers that may prevent those in greatest need from obtaining them. This challenges the ideals of health equity and affordability.

Montanaro looks favourably on companies that demonstrate strong commitments to improving health outcomes responsibly and sustainably. It is with this lens that we look at GLP-1 manufacturers and their supply chains. As investors specialising in Small and MidCap listed equities, we look beyond the drug manufacturers to the broader ecosystem that supports their development and distribution. This includes the specialist suppliers and partners – the “picks and shovels” of the pharmaceutical industry – that play a crucial role in enabling the production of life-changing medications.

Beyond just obesity drugs, we have a broader investment focus on companies that have a positive impact on cardiovascular disease (a leading cause of death worldwide, which is often associated with obesity). In particular companies selling innovative products used by surgeons to get better outcomes for their patients.

Engagement

Our commitment to making a meaningful difference extends to active advocacy and collaboration. The food industry has a critical role to play in this transition. By reformulating products to reduce harmful ingredients, investing in healthier food options, and marketing these choices responsibly, the industry can contribute significantly to improving public health outcomes. Montanaro has advocated for food companies to shift towards healthier products via participation in the ShareAction Healthy Markets initiative. Currently members of the coalition manage a total of $5.8 trillion in assets. This widespread support of the collaborative engagement group is indicative that investors are recognising that the long-term viability of their portfolios is directly linked to the health outcomes of the societies they serve. By advocating for healthier food and drink options, investors are not only contributing to the well-being of consumers but are also mitigating risks associated with regulatory changes, consumer preferences, and potential legal challenges that can affect companies that are unable to pivot away from a sole focus on unhealthy foods.

To further these advocacy efforts, Montanaro has recently joined The Investor Coalition on Food Policy. The objectives of the coalition are geared towards recognising the powerful role that corporate lobbying and reporting initiatives play in shaping food policy and, by extension, public health outcomes.

By pushing for standardised health and sustainability metrics, we aim to foster an environment where companies are held accountable for their impact on society and the planet.

Montanaro’s Approach to Nutrition in Investment

Given that public health is an important topic in sustainable investment, Nutrition forms one of the six themes in our impact strategy: the Montanaro Better World Fund.

We recognise the strains currently being exerted on food systems, health and nature. As a consequence, Montanaro invests in companies that strive for efficient food production, sustainable distribution, and the promotion of healthy eating. We search for companies that can evidence thematic revenue alignment by leading the way in securing and enhancing food security but are also actively contributing to the reduction of global greenhouse gas emissions through innovative practices that minimise food waste and maximise resource use. By focusing on these criteria, Montanaro’s investment strategy within our nutrition theme directly supports the United Nations Sustainable Development Goals.

Conclusion

Global obesity has cascading effects on public health and sustainability. As investors that aim to contribute positively to the world around us, we hope our engagement in initiatives like the ShareAction Healthy Markets and The Investor Coalition on Food Policy will help to drive systemic change. We call upon fellow investors and food manufacturers to join us in this goal. By prioritising the production and promotion of healthier food options, investing in sustainable food systems, and supporting policies that enhance public health, we can collectively drive a significant positive impact on society and the environment. Let’s leverage our influence to advocate for a healthier future, recognising that our investment choices have the power to shape a better world. Together, we can contribute to a shift that not only addresses the obesity epidemic but also aligns with the United Nations Sustainable Development Goals, ensuring healthy lives and promoting well-being for all.